Results of our 2026 Salary Increase Pulse Survey | Tightly aligned with summer projections.

January 2026

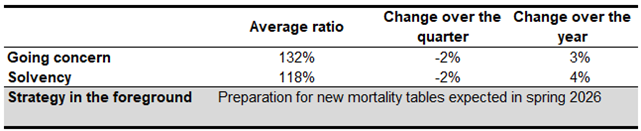

Normandin Beaudry Pension Plan Financial Position Index, December 31, 2025

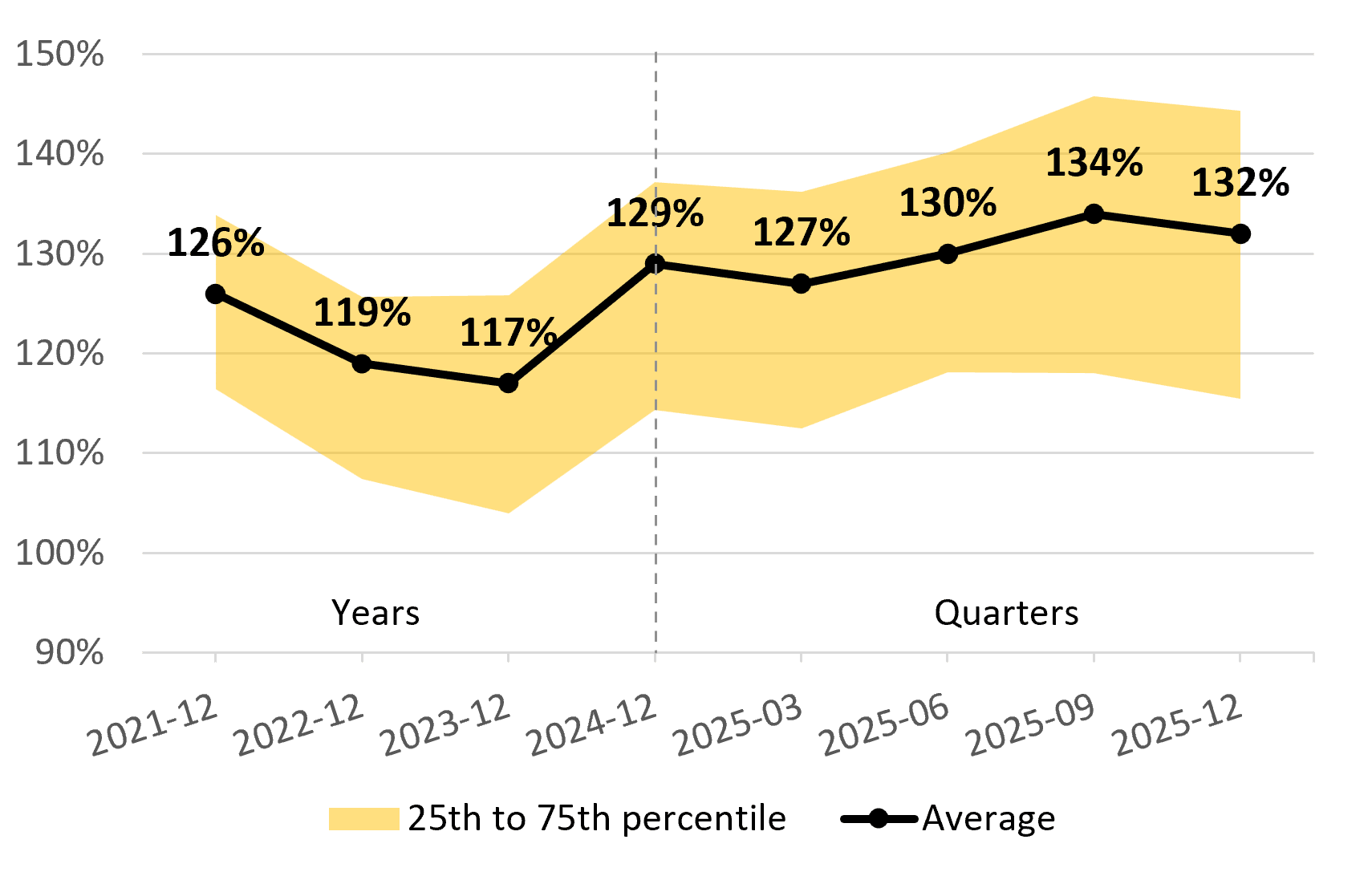

On December 31, 2025, Normandin Beaudry updated its pension plan financial position index, continuing the tracking initiated on December 31, 2021. Click the following link to view our segment specific to the Quebec municipal and university sector.

Pension plan surpluses trended upwards in 2025,

a year characterized by strong stock market returns and

a slight increase in long-term interest rates.

Regularly monitoring the change in a pension plan’s financial position allows for sound risk management and timely implementation of strategies. Our index tracks both funding valuation bases:

- going concern, which relies on long-term assumptions from a perspective of indefinite operation of the plan; and

- solvency, which measures financial position in the event of plan termination, relying on assumptions based on the bond market.

The reduction in the financial position over the last quarter of 2025 was due to slightly lower-than-expected investment returns. On a solvency basis, changes in prescribed interest rates also had a negative impact on the quarter’s results.

In some plans, de-risking in investment policy, increased margins for adverse deviations (going-concern basis), and the use of surplus are examples of factors that contributed to a slight reduction in average financial position.

Note: The illustrated funded ratio excludes the effect of asset smoothing. For a plan that uses this mechanism, less significant change in its financial position is expected.

In 2025, the average financial position of pension plans improved, with investment performance generally exceeding the discount rates used in actuarial valuations, both on a going concern and solvency basis.

These results are even more encouraging considering the dip in financial markets observed last spring in response to tariff disputes. At that time, consumer and investor confidence had fallen to levels similar to those seen in 2020 at the height of the pandemic. The subsequent recovery was remarkable, illustrating the resilience of the economy, even in countries more affected by U.S. tariffs.

The year 2025 was characterized by an unprecedented influx of capital into industries related to artificial intelligence. This transformation is increasing demand for energy and raw materials, prompting large-scale measures to limit price increases. Against this backdrop, China took the lead in innovation in terms of renewable energy generation and storage, with clean energy accounting for approximately 90% of global growth in electricity generation. Meanwhile, the United States focused on traditional energy industries and began actively taking steps to secure access to global resources, as demonstrated by its recent actions targeting Venezuela—which holds the world’s largest oil reserves—as well as Greenland and other Western countries. The global artificial intelligence race remains important to monitor due to its potential repercussions on financial markets, and more broadly on the labour market, wealth distribution and geopolitical dynamics.

Although central banks lowered their key rates over the year, particularly in Canada and the United States, long-term interest rates rose slightly. This generally has a positive effect on pension plans, which benefit from reduced actuarial liabilities and current service costs.

In a context where pension plans continue to demonstrate excellent financial health, surplus management remains a priority for many administrators. The publication of a new mortality table, expected in spring 2026, could have an impact on strategic thinking in this area, with results on a going-concern basis potentially affected as of December 31, 2025.

Keep in mind that a new mortality improvements scale (CanMI-2024) was published in 2024 and projects faster growth in life expectancy, leading to higher costs for pension plans. Most actuaries have not yet incorporated this new scale into their valuations, preferring to wait for the mortality table itself to be updated. If the table is published next spring as planned, valuation results will likely be affected by a combined use of the new table and scale. For now, it remains difficult to quantify the scope of this change.

Normandin Beaudry has conducted an in-depth study on mortality in Canada covering more than one million lives per year. Through our rigorous methodology based on income and place of residence, we offer our clients a more accurate estimate of mortality and a more precise valuation of pension benefits. This approach also has a direct influence on plan funding and the analysis of premium competitiveness during annuity purchases. Find out more about our approach here.

Want to learn more about the mortality assumptions that are appropriate for your plan? Contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its Canadian clients, excluding plans in the Quebec municipal and university sector. A separate index is published for these pension plans. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds. The discount rates for transfer values used on a solvency basis are those prescribed by the Canadian Institute of Actuaries and are therefore based on the previous month’s market interest rates.