Results of our 2026 Salary Increase Pulse Survey | Tightly aligned with summer projections.

September 2025

Salary increases for 2026: budgets continue to decline

This summer, more than 1,000 organizations across Canada participated in the 15th edition of Normandin Beaudry’s Salary Increase Survey. The detailed analysis conducted by our compensation specialists provides insights and trends that can be used to inform internal compensation decisions.

More detailed information is available in our interactive tool.

As Canada faces an economic slowdown compounded by ongoing tariff pressures and trade uncertainties, strategic planning relevant to salary increases is essential in retaining talent and maintaining workforce strength.

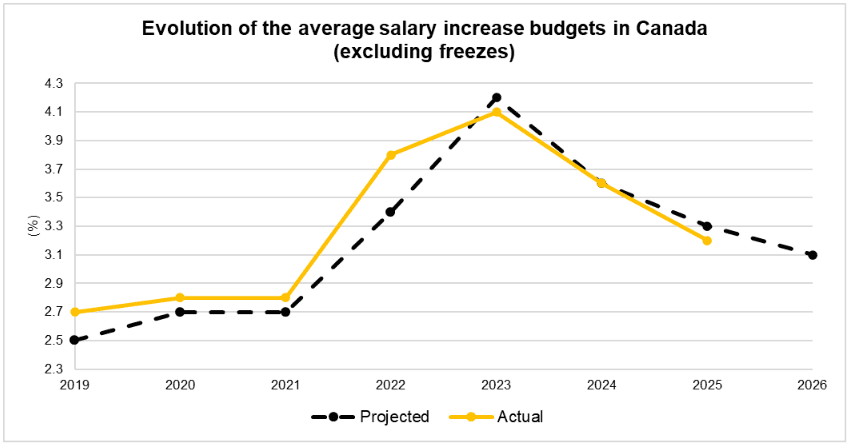

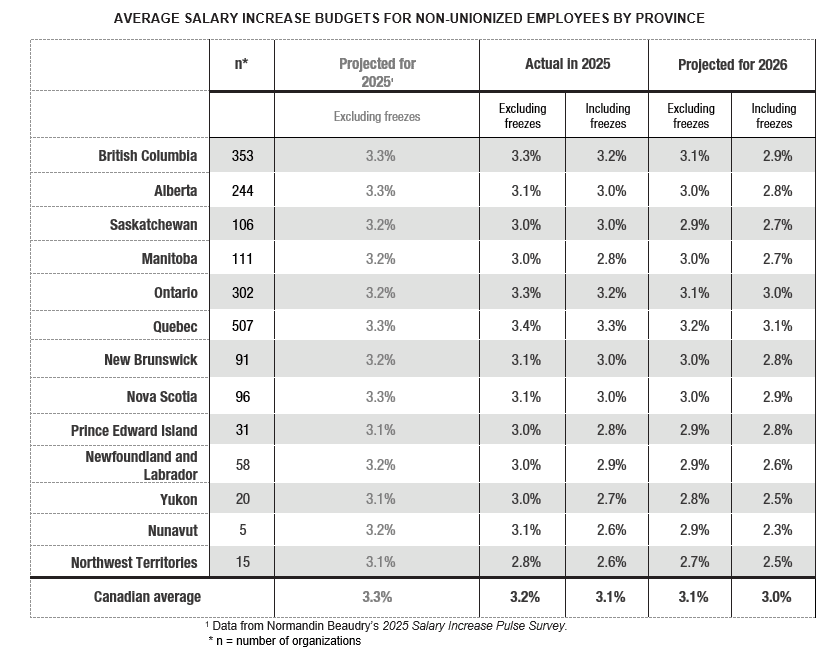

Organizations are expected to continue scaling back their salary increase budgets in 2026, with an average projected increase of 3.1%, excluding salary freezes, versus 3.2% in 2025.

Only 2,3 % of respondents reported freezing salaries in 2025, which is slightly below the initial forecast of 3 % published in September 2024. The 2026 survey shows 5,3 % of respondents projecting salary freezes for 2026..

Results point to a downward trend partly as a means to recession-proof their operations and due to a less constrained labour market. Actual increases in 2025 were 3.2%, slightly below our most recent projections of 3.3% published in January 2025.

2026 salary increase budget projections show minimal differentiation across ownership structures:

- Privately held (not listed on the stock market): 3.2%

- Not-for-profit organizations: 3.1%

- Publicly traded: 3.2%

- Government organization/Crown corporation: 3.0%

Organizations in the software and IT sectors reported the highest actual salary increase budget of 4.7% and 4.4% respectively for 2025.

The following sectors also reported higher average increases for 2025:

- Pharmaceutical: 3.8%

- Construction of buildings: 3.8%

- Telecommunications, data processing, data warehousing and related services: 3.7%

- IT consulting services: 3.7%

- Accommodation, food services and tourism: 3.5%

- Professional, scientific and technological services: 3.5%

- Real estate, rental and leasing: 3.5%

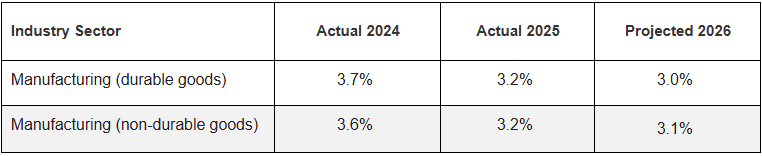

From 2024 to 2025 there was a sharp decline in actual salary increase budgets in the Canadian manufacturing sector, averaging approximately 0.5% due to ongoing tariff–related pressures. It is projected that this sector will undergo more moderate reductions in salary increase budgets for 2026.

Actual increases in 2025 (excluding salary freezes) are slightly below the most recent projection of 3.3% published in January 2025, with average increases trending to 3.2%. These figures indicate that organizations continue to exercise restraint in their compensation strategies.

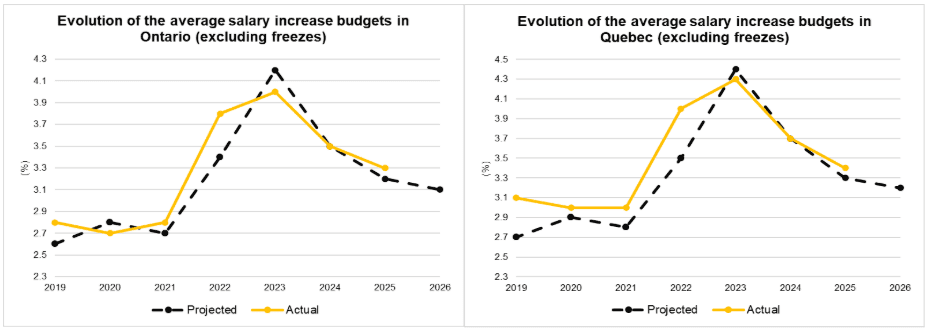

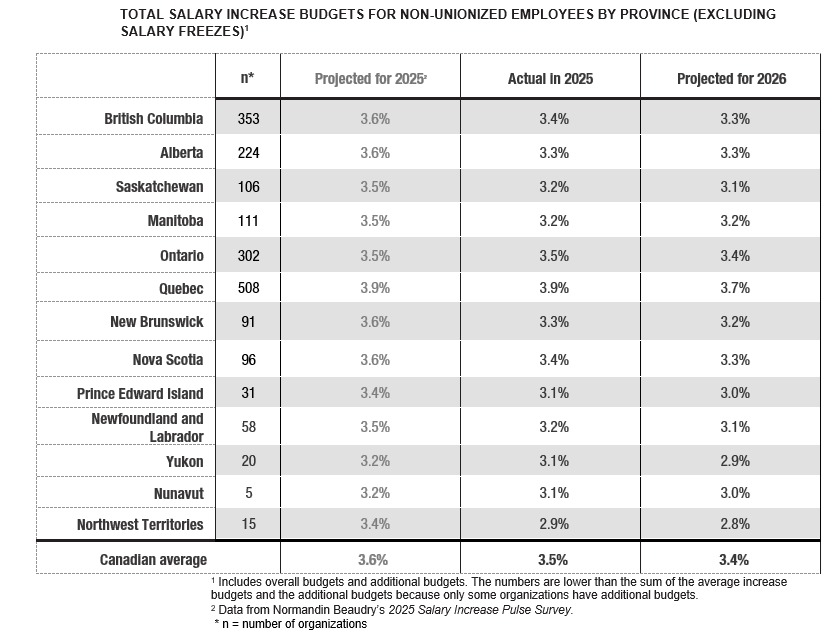

Most provincial projections report 2026 increases lower than the national average of 3.1%, with British Columbia, Ontario, and Quebec projecting the highest increases.

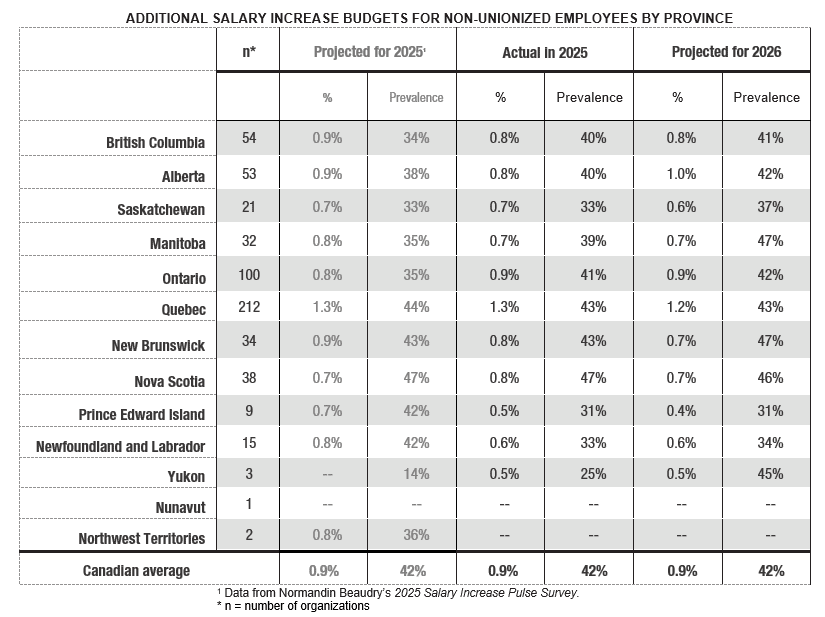

In 2025, 42% of responding organizations allocated an average additional budget of 0.9%, aligning with the initial January 2025 projection. For 2026, projections show that the same percentage of organizations (42%) are planning to secure additional budgets, maintaining an average of 0.9%. These organizations are planning to allocate them to:

- Support market adjustments to salaries (59%)

- Differentiate compensation for high performers (58%)

- Retain employees in strategic/critical roles (54%)

- Accelerate progression for employees lower in their pay range (38%)

- Address compression and internal equity challenges (37%)

- Retain employees with a perceived retention risk (27%)

- Provide for off-cycle salary increases (20%)

When accounting for reported additional budgets planned for 2026, average total salary increases expect to reach 3.4%.

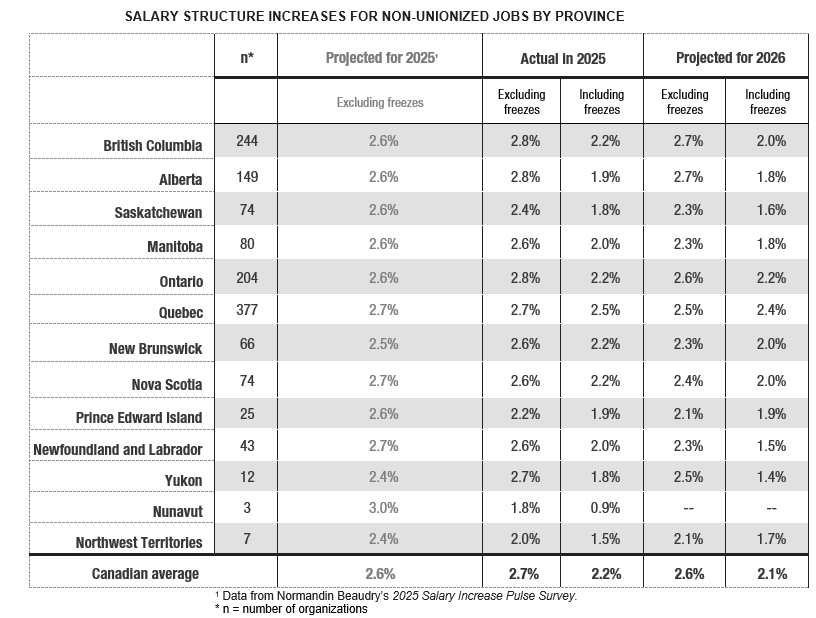

The average salary structure increase in 2025 was 2.7%, excluding organizations reporting a structure freeze, and 2.2% when including. Actual 2025 salary structure increases (excluding freezes) continue to stabilize following significant rises in the post-pandemic compensation cycles:

- 2022: 3.0%

- 2023: 3.4%

- 2024: 2.6%

- 2025: 2.7%

2026 projections signal more prudent salary structure increases, with an average of 2.6% (excluding freezes). Reported salary structure increases provide anecdotal evidence of a more balanced market, with organizations focusing on affordability to preserve cost structures as they manage annual salary increases.

Given the ongoing economic climate and persistent trade uncertainties, results indicate that organizations are continuing to scale back their salary increase budgets for 2026. Although the labour market has become less constrained, strategic planning around salary increases remains essential for talent retention and sustaining workforce strength.

Organizations hoping to set themselves apart may benefit from adopting innovative approaches to balancing monetary and non-monetary elements in their total rewards. Normandin Beaudry’s experts believe that striking the right balance can help organizations stand out from the competition.

Look out for our In the spotlight, a summary of the key topical questions, that will be shared with all participating organizations in a separate bulletin coming soon.

This year’s special themes will cover:

- Market/economic impact

- Tariffs and economic uncertainty

- Pay transparency strategies

- Artificial intelligence

- Diversity, equity and inclusion

Contact our specialists ignited by total rewards to learn more about the results of this survey.

Not on our “Surveys and polls” list? Subscribe now.