January 2023

Normandin Beaudry Pension Plan Financial Position Index | Quebec Municipal and University Sector

Today we are launching the Normandin Beaudry Pension Plan Financial Position Index. Our specialists closely monitor the financial position of our clients’ defined benefit pension plans and will present this index to you on a quarterly basis, and this, separately for the Quebec municipal and university sector.

2022 saw the biggest decline in financial position on a going concern basis since the pandemic greatly disrupted financial markets in the spring of 2020. Despite this, contribution requirements for pension funds in the municipal and university sector have proved resilient to such fluctuations, thanks in part to the robust funding mechanisms in place and favourable markets in recent years. This context provides a great opportunity to implement different risk management strategies.

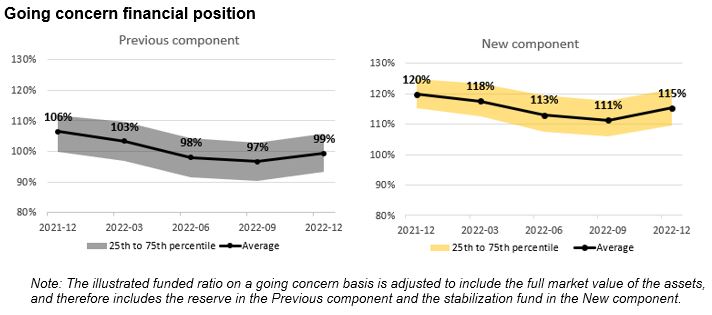

As at December 31, 2022, the average funded ratio of municipal and university sector pension plans is 99% for the Previous component and 115% for the New component (the components distinguish between years of service accumulated before and after January 1, 2014 for the municipal sector and January 1, 2016 for the university sector). The ratios for both plan components are respectively up by 2% and 4% over the last quarter, but down by 7 % and 5% for 2022.

The main factor in the deterioration of the financial position in 2022 was the poor performance of financial markets. This decline was partially offset by the reduction in value of pension plan liabilities, which is the result of using higher discount rates to evaluate pension plan liabilities thanks to a stronger investment return outlook than before.

The rise in discount rates has also brought down current service costs that would be required in the next actuarial valuation. It is therefore a good context to establish a contribution stability mechanism, if such an objective is part of the funding policy.

The average solvency ratio for municipal and university pension plans as at December 31, 2022 is 96% for the Previous component and 107% for the New component. The ratios for both of these plan components are respectively up 3% and 4% in the last quarter and up 7% and 14% for 2022.

The improvement in financial position on a solvency basis is explained by the fact that, under this basis, the positive impact of higher discount rates is greater than the impact of the poor performance of financial markets.

Pension fund returns were highly negative in the first two quarters, followed by modest positive returns in the last two quarters. The simultaneous decline in stock and bond markets witnessed at the height of the correction had not been seen in more than 50 years.

The context was marked by a labour shortage, accentuated by a large number of retirements, which led to a historically high employment rate. With inflation hovering between 6% to 8% in 2022 in most developed countries, including Canada, central banks tightened monetary policy while sending a strong message that their priority is to control inflation. Drawing lessons from the last inflationary period (the 1970s), they plan to stick to this difficult decision since the consequences of uncontrolled inflation would be worse than those of a recession.

As for fixed income, increases in central bank policy rates have had the effect of raising the interest rates of various bonds, resulting in sharply negative bond returns. Although the rise in interest rates was less pronounced on longer-term bonds, their returns were worse because of their greater sensitivity to changes in interest rates. Note that the yield curve is currently inverted: investors obtain a lower yield for longer-term loans, a situation that is unsustainable over the long term.

On the other hand, the performance of direct investments in real estate and infrastructure has been generally positive in 2022. Plans with greater exposure to these asset classes have tended to fare better.

2022 is a reminder of the importance of applying best practices when managing pension plans. A well-diversified investment policy and defensive investment styles were winning themes.

The current interest rate environment, in which rates have hit highs not seen for more than 15 years, offers risk management opportunities. For example, since investment risk can be reduced at a lower cost than in previous years, some plans may consider this strategy for the Previous component, which continually increases in maturity.

- Average funded ratio:

- Previous component: 99% as at December 31, 2022 / up 2% over the last quarter but down 7% for 2022

- New component: 115% as at December 31, 2022 / up 4% over the last quarter but down 5% for 2022

- Average solvency ratio:

- Previous component: 96% as at December 31, 2022 / up 3% over the last quarter and up 7% for 2022

- New component: 107.0% as at December 31, 2022 / up 4% over the last quarter and up 14% for 2022

- Returns in 2022 were strongly negative for equity and fixed income markets, but generally positive for direct investments in real estate and infrastructure

- Rise in discount rates in 2022, which decreases the value of liabilities and current service costs

- The current context presents risk management opportunities

If you have any questions, contact your Normandin Beaudry consultant or write to us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its clients in the Quebec municipal and university sector. A separate index is published for the plans of Canadian clients outside of this sector. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds.