October 2025

Normandin Beaudry Pension Plan Financial Position Index, September 30, 2025

Click here for our index that tracks the Quebec municipal and university sector.

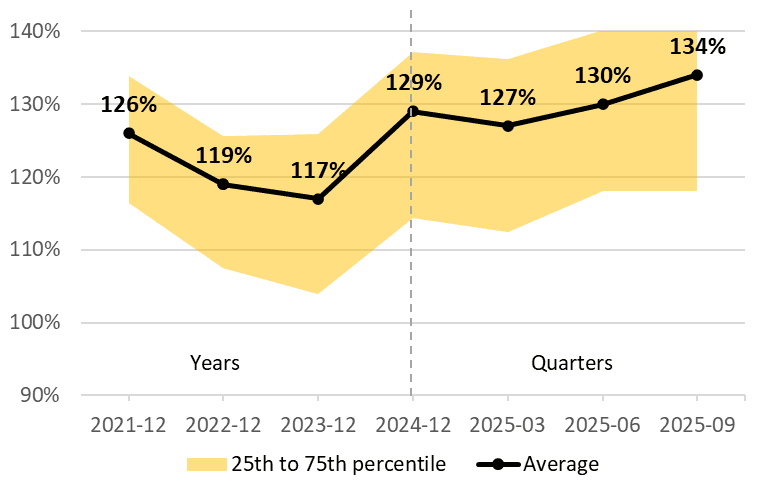

After remaining relatively stable in the first half of the year, the average funded ratio improved in Q3 2025. The average solvency ratio also improved over Q3, maintaining the positive trend that began at the start of the year.

As at September 30, 2025, the average pension plan funded ratio is 134%. The ratio is up 4% in the third quarter and up 5% year to date.

Note: The illustrated funded ratio excludes the effect of asset smoothing. For a plan that uses this mechanism, less significant change in its financial position can be expected.

The improved financial position in the third quarter is due to higher-than-expected investment returns, while pension liabilities changed little due to stable discount rates.

Average current service costs are in line with those seen at the beginning of the year.

The average solvency ratio of pension plans as at September 30, 2025, is 120%, up 5% in the third quarter and up 6% year to date.

The improvement in the solvency financial position in the third quarter is due to both higher-than-expected returns and a decrease in actuarial liabilities stemming from higher discount rates on that basis.

Stock markets once again posted favourable returns in Q3 2025. Continuing the trend of recent years, the surge in technology and AI stocks has boosted sector concentration in global stock market indices, which may cause some concern among investors.

The Canadian market is also experiencing concentration, but in a different sector. The S&P/TSX has charged up 24% since the beginning of the year, half of which in Q3, mainly thanks to the outstanding performance of the gold sector. In fact, stocks in this sector have risen sharply, and their weighting in the Canadian stock market index recently doubled to 13%. The rise in gold prices reflects investors’ efforts to hedge against higher inflation and U.S. dollar weakness relative to other currencies amid geopolitical risk and monetary policy uncertainty. Growing doubts about U.S. fiscal discipline and its dollar’s long-term dominance have further encouraged diversification in favour of gold as a safe-haven asset.

Long-term interest rates remain at a level comparable to the start of the year, while short-term rates continue to fall. The Bank of Canada cut its policy rate by 0.25% to 2.5%, continuing the monetary easing begun in April 2024, when the rate stood at 5%. The Fed also lowered its policy rate by 0.25%, but the U.S. policy rate remains higher than Canada’s, in the 4.00% to 4.25% range. In recently lowering their policy rates, the Bank of Canada and the Fed have chosen to prioritize managing the economic downturn and higher unemployment, believing that the risk of rekindling inflation remains limited.

Several pension plans entered 2025 in a particularly favourable financial position. Despite the short, sharp stock market correction in April 2025, financial markets subsequently reached historic highs, enabling most plans to maintain or increase their surpluses. Ongoing market uncertainty, notably linked to the lagging impact of tariffs on corporate earnings and the concentration within stock markets, could prompt a degree of caution in the use of these surpluses.

Since the emergence of surpluses in recent years, many plans have implemented various funding strategies, depending on the specific context of their pension plan. It is common for plans to have thresholds in place before using surpluses, margins for adverse deviations, or surplus use mechanisms that promote equitable consideration of all parties concerned.

Among the other strategies being deployed, the purchase of group annuities stands out as it allows the transfer of investment and longevity risks to an insurer. Conditions are currently favourable for this type of transaction, particularly in view of the relatively high level of mid- to long-term interest rates and the strong appetite of insurers.

Want to learn more about the various risk management strategies that are appropriate for your plan? Contact your Normandin Beaudry consultant or email us.

- Average funded ratio: 134% as at September 30, 2025, up 4% over the third quarter and 5% year to date

- Average solvency ratio: 120% as at September 30, 2025, up 5% over the third quarter and 6% year to date

- Q3 returns exceeded expectations for future returns, as dictated by the discount rate on a funding and solvency basis.

- Liabilities on a funding basis and current service costs showed little change, as discount rates remained similar to those of the previous quarter and the beginning of the year on this basis. Liabilities on a solvency basis decreased, as discount rates increased on this basis.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its Canadian clients, excluding plans in the Quebec municipal and university sector. A separate index is published for these pension plans. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds. The discount rates for transfer values used on a solvency basis are those prescribed by the Canadian Institute of Actuaries and are therefore based on the previous month’s market interest rates.