October 2023

Normandin Beaudry Pension Plan Financial Position Index, September 30, 2023

Click here for our index that tracks the Quebec municipal and university sector.

The average pension plan’s going concern position remained relatively stable in Q3 and since the beginning of the year, whereas their solvency position improved during those same periods. Higher interest rates are generally favourable for pension plans, whose financial situation has remained at enviable levels for some quarters.

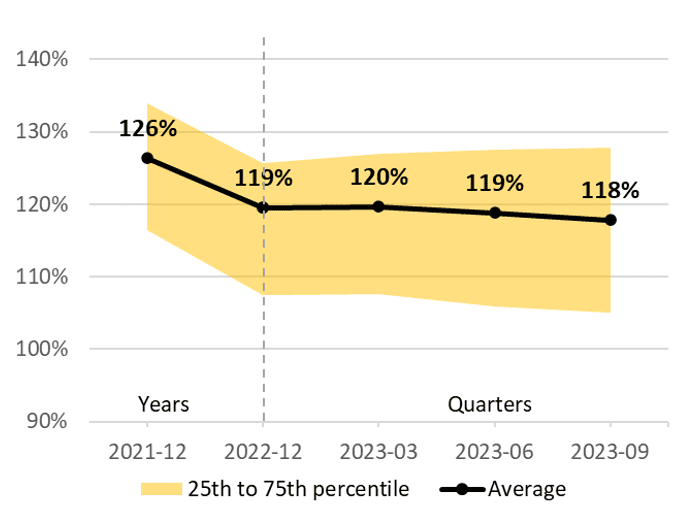

The average pension plan funded ratio, excluding the effect of asset smoothing, is 118% as at September 30, 2023, down 1% over the third quarter and down 1% since the beginning of 2023.

Note: The illustrated funded ratio excludes the effect of asset smoothing. A plan that uses this mechanism can therefore expect a less significant change in its financial position.

The financial position remained relatively stable during the quarter despite volatile financial markets. The markets’ performance was rather poor but was offset by a similar decline in the value of pension plan liabilities. This decline occurred because pension plan liabilities are calculated using higher discount rates following the increase in bond market interest rates.

The rise in discount rates has also brought down current service costs. However, the variation in current service contributions will only be reflected at the next actuarial valuation and will depend on mechanisms in place to stabilize contributions.

The average pension plan solvency ratio as at September 30, 2023, is 111%, up 1% over the third quarter and up 4% since the beginning of 2023.

Higher interest rates have been the key driver of this improvement since the beginning of the year. This is not to mention the effect of the significant rise in interest rates in September, the repercussions of which will be felt in October under the rules set out by the Canadian Institute of Actuaries.

Despite a positive start to the quarter, the average pension fund generated negative returns in Q3 2023 in both stock markets and bond markets. Returns have been generally positive since the beginning of the year, mainly due to positive stock market returns during that period.

Inflation continues to be the focus of attention of various financial markets. Although annual inflation slowed down at the beginning of the year, it remains today above target. The central banks’ battle with inflation is not over, and interest rate hikes may continue for longer than what the markets had initially anticipated. While the economy has proved resilient so far, inflationary pressures may eventually affect the job market and a growing number of companies.

Increases in interest rates over the past two years have resulted in significant decreases in pension plan liabilities, which corresponds to the current value of a pension plan’s future commitments to its members.

If this decline in pension plan liabilities is welcome news from a pension plan’s point of view, can the same be said from the perspective of active members, whose commuted pension values declined at the same pace? Members may only realize the impact of the significant increase in interest rates throughout 2022 when they receive their annual statement this year.

Consider adopting a proactive communication strategy to address this situation. Members’ general meetings are a great opportunity to remind them that, unlike commuted values, the pension accrued in their defined benefit plan is not affected by the ebbs and flows of financial markets.

- Average funded ratio: 118% as at September 30, 2023 / down 1% over the quarter and down 1% year-to-date

- Average solvency ratio: 111% as at September 30, 2023 / up 1% over the quarter and up 4% year-to-date

- Negative returns over the quarter in both stock markets and bond markets

- Increase in discount rates on a going concern and on a solvency basis, which decreases the value of liabilities and current service costs

If you have any questions, contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its Canadian clients, excluding plans in the Quebec municipal and university sector. A separate index is published for these pension plans. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds.