October 2024

Normandin Beaudry Pension Plan Financial Position Index – Quebec Municipal and University Sector, September 30, 2024

Click here for our index which tracks the private sector.

In Q3 2024, the average pension plan’s going concern financial position remained stable. Solvency remained stable for the Previous component but deteriorated for the New component.

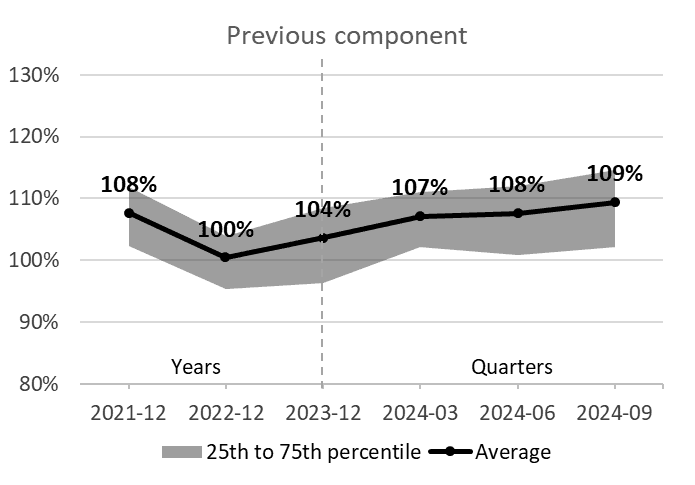

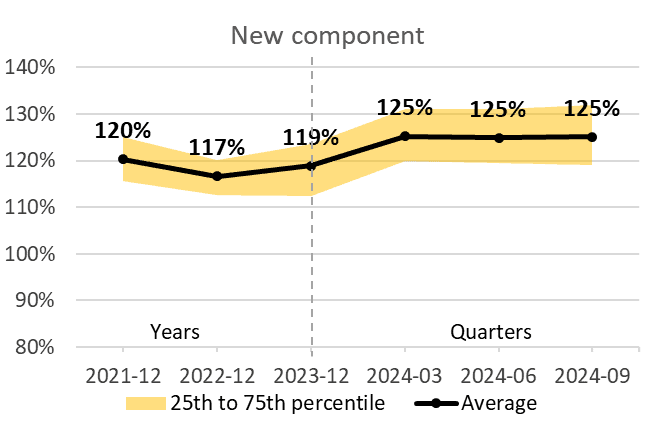

As at September 30, 2024, the average funded ratio of municipal and university sector pension plans is 109% for the Previous component and 125% for the New component (the components are distinguished by years of service accumulated before and after January 1, 2014, for the municipal sector and January 1, 2016, for the university sector). The ratio for the Previous component is up 1% in the third quarter and up 5% since the beginning of the year. The ratio for the New component remained stable in the third quarter, but is up 6% since the beginning of the year.

Note: The illustrated going concern financial positions are adjusted to include the full market value of assets, and therefore include the reserve in the Previous component and the stabilization fund in the New component, and exclude the effect of asset smoothing.

The financial position changed little in Q3 2024. Although investment performance was favourable, pension liabilities increased due to lower discount rates.

Current service costs increased in the Q3 2024, bringing them close to levels seen at the beginning of the year.

The average solvency ratio for municipal and university sector pension plans as at September 30, 2024, is 102% for the Previous component and 109% for the New component. The ratio for the Previous component is down 1% in the third quarter, but up 2% since the beginning of the year. The ratio for the New component is down 5% in the third quarter and down 2% since the beginning of the year.

As with the going concern position, investment performance was favourable and actuarial liabilities of pension plans increased due to lower discount rates. However, the impact of lower discount rates was more significant for the New component, given its lower maturity.

Since peaking in 2023, central banks recently announced their first rate cuts: three 0.25% cuts by the Bank of Canada and one 0.5% cut by the U.S. Federal Reserve. With annual inflation currently sitting in its target range of 1% to 3%, the Bank of Canada’s attention has turned to weaker economic growth and rising unemployment.

Despite the economic slowdown, the main stock and bond indices delivered strongly positive performances in response to central bank stimuli. In general, U.S. tech giants continued to dominate the markets, accentuating the high concentration of AI-related stocks in global market indices. Low-volatility equity strategies also performed well during the quarter, despite their more defensive profile.

Even if the recent key interest rate cuts have no immediate impact on direct real estate and infrastructure investments, they will generally have a positive long-term impact on the valuation of these assets.

Given the favourable financial position of pension plans, it may be a good time to review the investment strategy using a funding-driven investment (FDI) analysis, otherwise known as “asset-liability analysis”, especially if there have been significant changes to the following factors since the last analysis:

| Factors | Examples |

|

|

|

|

|

|

|

|

Moreover, the FDI analysis is in line with the risk management framework described in Guideline No. 10 issued by the Canadian Association of Pension Supervisory Authorities (CAPSA) in September. The purpose of this guideline is to define best practices for risk management in pension plan administration, taking into account the fiduciary duties incumbent on administrators.

- Average funded ratio:

- Previous component: 109% as at September 30, 2024 / up 1% in the third quarter and up 5% since the beginning of the year

- New component: 125% as at September 30, 2024 / no change over the third quarter and up 6% year-to-date

- Average solvency ratio:

- Previous component: 102% as at September 30, 2024 / down 1% over the third quarter and up 2% year-to-date

- New component: 109% as at September 30, 2024 / down 5% over the quarter and down 2% year-to-date

- Positive returns over the quarter in stock and bond markets

- Lower discount rates in the third quarter, increasing liabilities and current service costs

Would you like to learn more about using a funding-driven investment analysis for risk management? Contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its clients in the Quebec municipal and university sector. A separate index is published for the plans of Canadian clients outside of this sector. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds. The discount rates used on a solvency basis are those prescribed by the Canadian Institute of Actuaries, and those for transfer values are therefore based on the previous month’s market interest rates.