February 2023

The Top 10 Developments in Drug Insurance of 2022

A look back at the highlights of a challenging year. Here is the eighth edition of our top prescription drug developments of the past year.

GOVERNMENT POLICIES

1. Biosimilars and their impact on insurers

2. Expiry of patents for biologic drugs

3. Reform of the Patented Medicine Prices Review Board (PMPRB) postponed indefinitely

5. Scope of practice expanded for pharmacists

MARKET TRENDS

7. Equity, diversity and inclusion (EDI) – plan design

OTHER HIGHLIGHTS

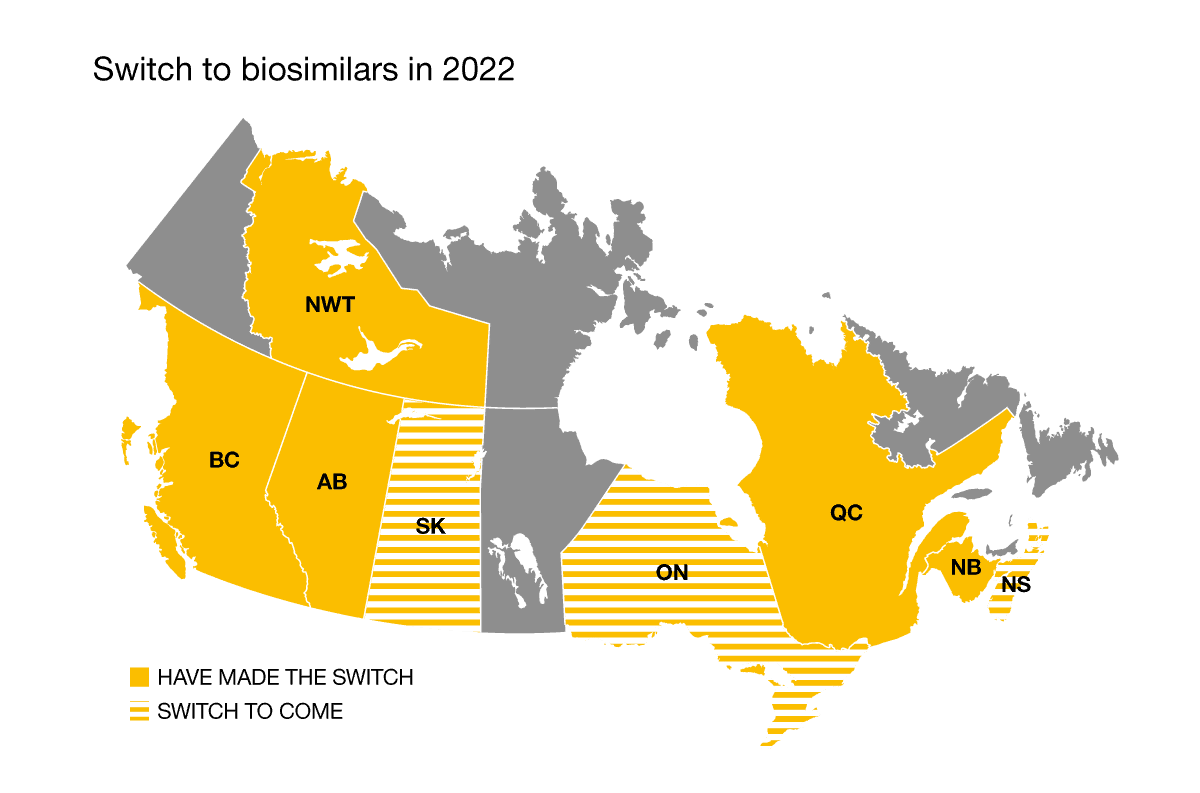

2022 was a pivotal year in the switch to the use of biosimilars. Quebec and the Northwest Territories officially joined the national movement on April 12 and on June 20, 2022, respectively. Meanwhile, Nova Scotia, Saskatchewan and Ontario will be making the switch to biosimilars in February, April, and December 2023.

Insurers have come up with various approaches to managing biosimilars, including imposing a mandatory switch, making no transition, or letting plan holders decide. The transition has been successful among insurers who’ve imposed the switch, with very few exceptions.

Byooviz, the first biosimilar to Lucentis, entered the market in 2022. Aside from that one event, 2022 was a quiet year in terms of new biosimilars challenging blockbuster biologic drugs.

However, the tide is expected to turn in 2023: while many Humira biosimilars already exist, close to a dozen more are expected to hit the market this year.

Additionally, a handful of reference biologic patents are set to expire in the coming years: the patents for Stelara, Simponi and Eylea will expire in 2024 while Soliris and Entyvio face patent expiration in 2025. These biologics alone accounted for nearly 5% of eligible prescription drug spending in 2021.

The switch to biosimilars is a significant cost-control measure, and the upcoming patent expirations will result in additional savings.

The PMPRB reform went unnoticed during the first half of 2022. On July 1, 2022, the reform was implemented but the new guidelines were not amended; in other words, it was an implementation with status quo. A call to comment and revise the draft guidelines was issued for the January 1, 2023 implementation. However, on December 16, the PMPRB announced it would not be implementing new guidelines.

Such a reform would have lowered the costs of private insurance plans.

High-cost claimants are on the rise with the arrival of new and expensive drugs on the market.

To deal with this situation, the Quebec Drug Insurance Pooling Corporation (QDIPC)—the Canadian benchmark for establishing pooling levels and fees—announced it would be lowering pooling fees. Indeed, QDIPC pooling fees were lowered on January 1, 2023, for most pooling thresholds. This was a welcome move given the upward pressure on drug costs. The last time pooling fees were lowered was in 2019, which was then followed by three hikes.

Despite the general lowering of fees for 2023, the impact on pooling costs has yet to materialize for insurers.

Last November, the government of Ontario announced that starting January 1, 2023, pharmacists would be permitted to prescribe medication for thirteen common ailments. By expanding the ability of pharmacists to provide care, it makes it faster and easier for patients to receive care. The province hopes this will help to reduce the demand on hospitals and clinics. Ontario is not the first province to widen the responsibilities of its pharmacists, as Quebec has already been doing so for some time.

In Quebec, a new agreement was signed between the Ministry of Health and Social Services and the Association Québécoise des Pharmaciens Propriétaires (Quebec Association of Pharmacy Owners). One of the components of this agreement focuses on the dispensing fees of pharmacists. Increases ranging from 2% to 3.5% are expected in the coming years at the RAMQ. Given the current context, we can expect a significant increase in pharmacist markups for private drug insurance plans.

Another component of the agreement suggests modifying the compensation model of pharmacists, with fees to be determined based on the complexity and intensity of the services provided. This new model will bolster the pharmacist’s role as a front-line professional in the healthcare system.

Many weight-loss drugs have entered the market in recent years. Notably, Ozempic has been all over the news as social media, TV and newspapers have touted its weight-loss properties, despite it being a drug meant to treat type 2 diabetes. Surging demand for the drug has led to significant shortages in recent months.

People are definitely looking for a weight-loss solution. Wegovy, which has the same molecule as Ozempic (semaglutide) but at a higher dose, is specifically approved for weight loss. Wegovy was recently approved by Health Canada. And in November, Health Canada also approved Mounjaro, a prescription drug with similar effects to the gastric sleeve—a type of bariatric surgery.

The Canadian Agency for Drugs and Technologies in Health (CADTH) remains cautious in the face of these new drugs. Its analysis of Wegovy is negative and it recommends that the drug should not be reimbursed. As for Mounjaro, it remains under analysis by the CADTH.

In Quebec, the Institut national d’excellence en santé et en services sociaux (INESSS) is currently assessing the effectiveness, safety, efficiency and recommended use of obesity drugs in order to assist the Ministère de la Santé et des Services sociaux as it considers the relevance of extending public coverage to this type of drug for certain well-defined groups. Weight-loss drugs have been on the RAMQ’s exclusion list since 1997.

With expenses related to obesity and weight loss expected to climb in the coming years, insurance plans could gain from reducing expenses related to comorbid conditions such as diabetes, high cholesterol, hypertension and mental health.

How employees perceive their group benefits plan is crucial. In 2022, many organizations carried out an EDI assessment of their group insurance plan. Overall, diversity elements related to health conditions were lacking. In terms of prescription drugs, many elements pertaining to the design of the plan can be made more equitable, including providing greater coverage for vaccines and medications to treat obesity, smoking cessation, sexual dysfunction, or family building (i. e. infertily).

Many caring employers are on the right path and contribute actively to the positive social impact of equity, diversity and inclusion. What was appropriate a few years ago may no longer be adequate today, and that is an ongoing process to keep in mind.

In 2022, the Quebec government published a policy on rare diseases. This first-of-its-kind policy in Canada aims to facilitate access to appropriate health care and services for patients suffering from rare diseases that are equitable, inclusive and culturally sensitive. Quebec will also publish an action plan in 2023 to carry out the various objectives of this policy and set out financial measures to ensure its longevity.

National coverage of prescription drugs for rare diseases is a solution that Normandin Beaudry has been touting since the publication of its white paper on national pharmacare in 2018. In 2022, MAPOL, the pharmaceutical industry’s leading experts on private and public payer drug plans in Canada, also published a white paper on the management of the financial risk of rare diseases. Its findings were the same as ours: national coverage of drugs to treat rare diseases is needed.

The 2022 federal budget had no mention of developments on national pharmacare, but the government is committed to introducing the Canada Pharmacare Act by the end of 2023.

Dexcom is a continuous glucose monitoring system that provides glucose alerts and readings on the patient’s phone. Until now, insurers covered Dexcom as a medical device and not as a drug, as opposed to the FreeStyle Libre system, which has always been covered under drug insurance plans.

The device has been available for purchase in pharmacies since 2022. This ease of access has prompted many insurers to recognize it as a drug, leading to an increase in diabetes medication spending in private insurance plans.

The combined impact of COVID-19 and of worker shortages continues to linger, as manufacturers are facing supply issues for some children’s medication.

There is a significant shortage in Canada of antibiotics such as Amoxicillin, which is used to treat bronchitis, pneumonia and ear infections, and Clavulin, a treatment for bacterial infections. Ibuprofen and acetaminophen products such as Tempra, Tylenol, Advil and Motrin are no exception. These products are slowly trickling into pharmacies and, when they are available, are sold in limited numbers.

Would you like more information? Contact your Normandin Beaudry consultant or email us.