January 2024

Normandin Beaudry Pension Plan Financial Position Index, December 31, 2023

Click here for our index which tracks the Quebec municipal and university sector.

After a significant rise in interest rates in previous quarters, the year ended with slightly lower rates than at the beginning of 2023. Despite the large variation of this key indicator, the financial position of the average pension plan remained relatively stable over the year. This favourable financial position allows many administrators and pension committees to prioritize and implement strategies that benefit their organization.

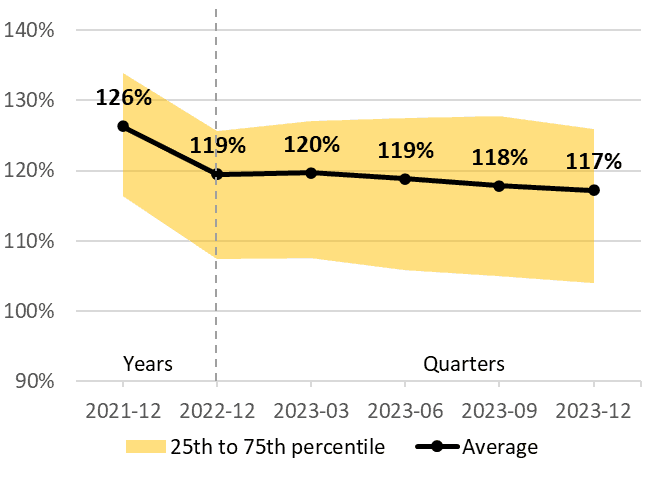

The average pension plan funded ratio, excluding the effect of asset smoothing, is 117% as at December 31, 2023, down 1% in the fourth quarter and down 2% since the beginning of the year.

Note: The illustrated funded ratio excludes the effect of asset smoothing. A plan that uses this mechanism can therefore expect less significant change in its financial position.

Returns were very positive in 2023, especially in the last quarter, in both stock markets and bond markets. Gains in the fourth quarter were offset by an increase in value of pension plan liabilities. During the quarter, bond market interest rates fell by a staggering 1%, which had a downward impact on discount rates.

Furthermore, the decrease in discount rates has increased current service costs significantly during the quarter, but only slightly since the beginning of the year.

The average solvency ratio as at December 31, 2023 is 110%. The ratio is down 1% in the fourth quarter of 2023, but up 3% since the beginning of the year.

The solvency financial position remained relatively stable in the fourth quarter. Similarly to the going concern position, positive returns were offset by the negative impact of lower discount rates. However, part of the impact of the decline in interest rates in December 2023 will only be felt in January 2024 under the rules set out by the Canadian Institute of Actuaries.

On December 6, the Bank of Canada maintained its key rate at 5%, followed by the Federal Reserve on December 13. Bond market interest rates have fallen substantially since their October peak, as financial markets are anticipating significant key rate cuts in 2024. For example, after starting the year in negative territory, the FTSE Canada Long Bond Index generated a return of 14.8% in the final quarter, for a positive return of 9.5% for the year.

Pension plans are currently in good financial shape thanks to the financial markets and an economy that proved resilient despite the events of the past three years: a pandemic, a period of rampant deficits and unprecedented stimulus by governments and central banks, wars in Eastern Europe and the Middle East, a rare period of inflation and rapidly rising interest rates, a downgrade of the U.S. credit rating, disruptive technological and climatic changes, and widespread anticipation of a recession that has yet to materialize, mainly due to a strong job market.

The era of sustained quantitative easing to stimulate the economy from 2008 to 2019 after the great financial crisis has given way to a new turbulent period for investors.

After the production of actuarial valuations as at December 31, 2022, many pension plans reported a surplus. This surplus, likely maintained throughout the last year, enables many organizations to review their plan’s strategic directions, including:

Investments:

- Has the investment policy been revised to reflect current market opportunities, including higher interest rates?

- Do investment policies and general investment decisions incorporate sustainable investment considerations? How will the portfolio need to evolve in the face of climate change?

- How will the plan respond to the increased maturity, amplified by demographic changes such as the aging population?

Funding:

- Does the funding valuation make use of enough financial provisions to meet the long-term objectives of the funding policy?

- Does the favourable financial position make it possible to implement or accelerate a risk reduction plan? For example, what would be the impact of a segmentation strategy on plan funding and on the risk/return profile?

- What impact would the purchase of insured annuities have on the plan’s financial position, maturity and risk tolerance?

Benefits:

- Would adjusting certain benefits help the organization attract and mobilize talent in the context of labour shortages by promoting, for example, flexibility or equity, diversity and inclusion (EDI) principles

- How does inflation affect plan members? Are there benefit adjustment mechanisms that depend on the plan’s financial health?

- Are current service contributions still adequate? Are deficit payments contributed in the past covered by a banker’s clause?

Of the above strategies, what are your priorities for 2024?

- Average funded ratio: 117% as at December 31, 2023 / down 1% over the fourth quarter and down 2% since the beginning of the year

- Average solvency ratio: 110% as at December 31, 2023 / down 1% over the quarter and up 3% since the beginning of the year

- Positive returns in the fourth quarter and over the year 2023, in both stock and bond markets

- Going concern and solvency discount rates in the fourth quarter dipped to levels slightly lower than at the beginning of the year, resulting in an increase in liabilities and current service costs

If you have any questions, contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its Canadian clients, excluding plans in the Quebec municipal and university sector. A separate index is published for these pension plans. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds. The discount rates on a solvency basis are those prescribed by the Canadian Institute of Actuaries, and those for transfer values are therefore based on the previous month’s market interest rates.