June 2019

Pay equity in federally regulated organizations

On December 13, 2018, the federal government’s second Budget Implementation Act for Budget 2018, which establishes the Pay Equity Act, received Royal Assent. Once it comes into force, the Act will apply to federally regulated public- and private-sector employers with 10 or more employees —Except for corporations listed in Schedules IV or V of the Financial Administration Act (art. 3 (2))—. Employers governed by the Act will have three years to comply. The Act aims to ensure that employees who occupy positions in predominantly female job classes receive “equal compensation for work of equal value” (Art. 2).

Once the details have been established, we will notify you of the Act’s effective date and remind you of your obligations pursuant to the Act, along with the deadlines for meeting them.

Until the Act comes into force, we are encouraging organizations to be proactive by implementing fair compensation policies and practices for all job classes. Aside from helping you comply with legal requirements, a clear, structured, fair and gender-neutral policy will help you attract and retain the most talented employees.

Our interpretations of the main provisions of the Pay Equity Act that apply to federally regulated organizations are as follows:

Organizations with at least 100 employees, or those with fewer than 100 employees if some of its employees are unionized, must establish a pay equity committee, or at least make all reasonable efforts to establish one.

Notice

The process starts by posting a notice for employees. This notice must set out the employer’s obligation to form a committee and the rules governing its composition, if applicable. It should also inform employees of their rights.

The Act also provides the option of establishing more than one pay equity plan per organization, subject to approval by the Pay Equity Commissioner. An application for a separate plan may be submitted by the employer, a bargaining agent for unionized employees or a non-unionized employee (Art. 30 (1)). Each of the plans must ensure that enough predominantly male job classes can be identified or the application may be denied by the Pay Equity Commissioner (Art. 30 (5)).

Identification of job classes

Positions may be considered to be in the same job class if they meet the following three criteria (Art. 32):

- Similar duties and responsibilities

- Similar qualifications

- Same compensation plan and same range of salary rates

Determination of predominantly female and predominantly male job classes

Three criteria are used to determine whether a job class is predominantly male or female (Art. 36 and 37):

- Female or male representation rate in the job class (at least 60% of the positions are held by people of the same gender)

- Historical representation rate for that job class within the organization

- Gender-based occupational stereotyping

It is also allowed to treat a group of job classes as a single, predominantly female job class if at least 60% of the positions in the group are occupied by women (Art. 38 (1)).

Determination of value of work

Under Article 41 (1), if job classes are identified as predominantly male or female, the value of the work performed in each job class must be determined by a method using the four evaluation criteria below (Art. 42):

- Skills

- Efforts

- Responsibilities

- Working conditions

If the value of the work performed in the jobs has already been determined using such a method, the employer or committee can decide to use these evaluations for the pay equity plan (Art. 41 (2)).

Calculation of compensation

In addition to salary, the compensation associated with each job class, expressed in dollars per hour, must be calculated while taking into account the various forms of compensation that are not equally available to all job classes covered by the plan (Art. 3 (1), 44 (1) and 45).

However, the legislation provides for authorized differences in compensation, and excludes some differences in compensation from the calculation (Art. 46) if they are based on the following:

- System of compensation based on seniority

- Maintenance of compensation following an employee’s reclassification or demotion

- Shortage of skilled workers

- Geographic area in which an employee works

- Participation in an employee development or training program

- Temporary, casual or seasonal nature of a position that results in a lack of compensation in the form of benefits

- Existence of a merit-based compensation plan that is based on a formal system of performance ratings that is known to employees

- Compensation for extra-duty services

Comparison of compensation

The Act sets out two methods for comparing compensation for predominantly female and predominantly male job classes (Art. 48 (1)).

The first, known as the “equal average method”, compares the average compensation associated with the predominantly female job classes with that of the predominantly male job classes within a band determined by a range of points (or within the band closest to that band) (Art. 49 (1)).

Under this method, the compensation for a predominantly female job class is to be increased only if the following two conditions are met:

- The compensation for that job class is lower than the average compensation for predominantly male jobs within the same band or within the band closest to that band;

- The average compensation for predominantly female job classes within a band is lower than the average compensation for predominantly male job classes within the same band or within the band closest to that band.

If required, the increase in compensation for a predominantly female job class must be made in such a way that the average compensation for predominantly female job classes and predominantly male job classes within the same band (or the bands closest to that band, if applicable) is equal.

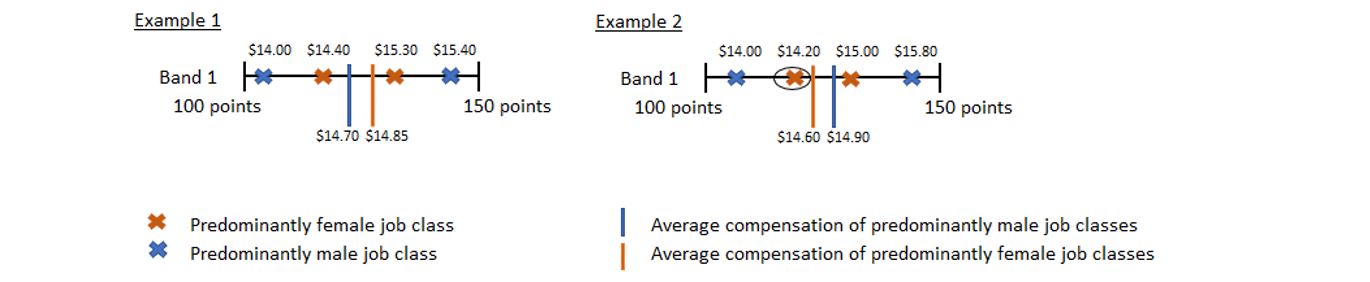

In the following examples, the compensation for the predominantly female job class increases only in Example 2.

In Example 1, the average compensation for predominantly female job classes ($14.85) is higher than the average compensation for comparable job classes that are predominantly male ($14.70). Consequently, no adjustment is made.

In Example 2, the average compensation of predominantly female job classes ($14.60) is lower than the average compensation for comparable job classes that are predominantly male ($14.90), and compensation for the circled female job class ($14.20) is lower than the average compensation for comparable job classes that are predominantly male. The circled female job class would therefore receive a $0.60/hour raise so that the average compensation for predominantly male and predominantly female job classes within the same band are equal.

The second method, known as the “equal line method,” stipulates that the regression line calculated for predominantly male job classes must be compared with the regression line for predominantly female job classes (Art. 50 (1)).

Under this method, the compensation for a predominantly female job class is increased only if the following two conditions are met:

- The female regression line is entirely below the male regression line

- The predominantly female job class is located below the male regression line

If required, the increase in compensation for one or more predominantly female job classes must ensure that the female regression line coincides with the male regression line.

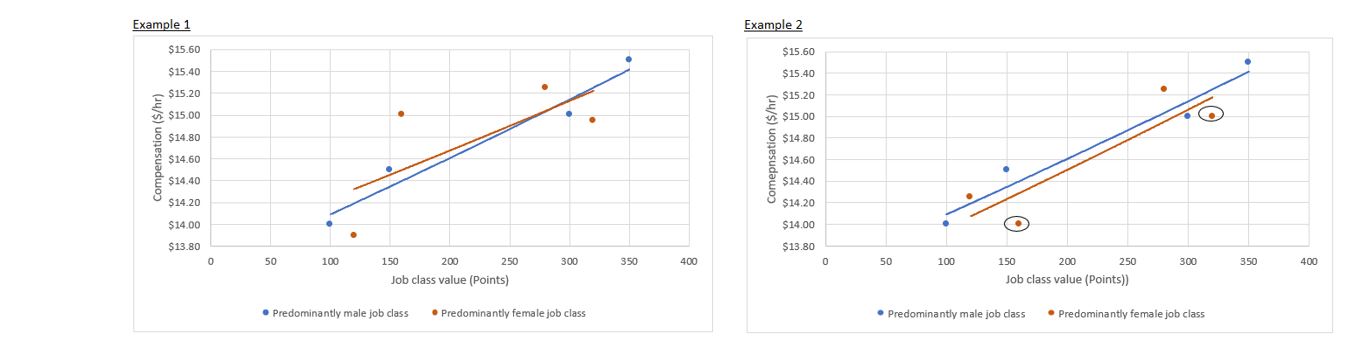

In the following examples, only Example 2 resulted in adjustments for certain predominantly female job classes (see the circled items).

In Example 1, even though some predominantly female job classes are below the male regression line, the female regression line is not entirely below the male regression line. Consequently, no adjustment is made.

In Example 2, only the two circled job classes receive an adjustment because both classes fall below the male regression line, while the female regression line falls entirely below the regression line for predominantly male job classes.

Article 48 (2) provides for other methods to be used, under certain conditions.

- An employer can apply to the Pay Equity Commissioner for authorization to use a method prescribed by regulation or a method suggested by the employer.

- A pay equity committee can decide to apply a method prescribed by regulations or another method that it considers appropriate.

Posting

Employers then inform employees of the strategy by posting an outline of the pay equity plan that provides details on each step (Art. 52). It must indicate compensation adjustments to which some predominantly female job classes would be entitled, as well as the date on which these adjustments come into force. Information on employee rights and recourse rights must also be included in the outline (Art. 51).

Employees have 60 days to provide the employer with their written comments (Art. 54 (1)).

The final version of the plan, which takes comments received into account, is then posted. It must be posted no later than the third anniversary of the date on which the employer became subject to the Act (Art. 55 (1)).

A revised version of the pay equity plan must be posted no later than the fifth anniversary of the day on which the most recent plan was posted (Art. 83 (1)).

As with the first plan, the employer must post a notice (Art. 80).

The process for updating the plan is described very briefly and the steps to be followed are not specified as clearly as for the initial process. In fact, Article 78 (1) only specifies that “any differences in compensation between the predominantly female job classes and the predominantly male job classes as a result of any change, since the most recent posting of the pay equity plan, that is likely to have had an impact on pay equity” must be identified.

The pay equity plan must then be updated, taking into account any differences in compensation, if applicable, and employees must be notified through a posting.

Under Article 89.1, each employer subject to this Act must file an annual statement with the Pay Equity Commissioner. The statement must include information on the most recent version of the pay equity plan, such as the date, whether a committee was involved, the number of job classes entitled to an increase and the amount of adjustments required.

Would you like more information?

Contact your Normandin Beaudry consultant or email us.