July 2025

Normandin Beaudry Pension Plan Financial Position Index, June 30, 2025

Click here for our index that tracks the Quebec municipal and university sector.

Despite high volatility in financial markets in the first half of the year, the financial position of pension plans recovered in the second quarter of 2025. Funded and solvency ratios improved compared to those at the beginning of the year.

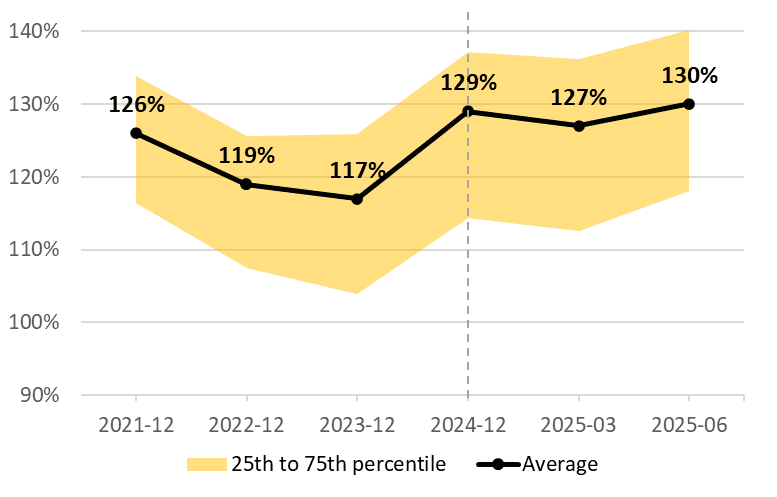

As at June 30, 2025, the average pension plan funded ratio is 130%. The ratio is up 3% in the second quarter and up 1% year-to-date.

Note: The illustrated funded ratio excludes the effect of asset smoothing. For a plan that uses this mechanism, less significant change in its financial position can be expected.

The improved financial position in the second quarter is due to higher-than-expected investment returns and a slight increase in discount rates.

Average current service costs are comparable to those at the beginning of the year.

The average solvency ratio of pension plans as at June 30, 2025 is 115%, up 4% in the second quarter and up 1% year-to-date.

The improvement in solvency financial position in the second quarter is due to both higher-than-expected returns and a decrease in actuarial liabilities resulting from higher discount rates.

Stock markets were particularly volatile in the second quarter due to the tariff saga. In fact, the MSCI World Index dropped by 12% in Canadian dollars in the days following “Liberation Day” on April 2, 2025, and rebounded just as quickly when the U.S. government backed down on its new stance on tariffs. The U.S. government also announced an expansionary fiscal policy, which will translate to a significant increase in the budget deficit and debt ceiling. The escalation of the conflict in the Middle East in June also contributed to market volatility, highlighting the persistence of geopolitical risks worldwide. Nonetheless, the returns of the main stock indexes year-to-date are in positive territory.

In the second quarter, the Bank of Canada kept its key interest rate at 2.75%, delivering a second consecutive pause after seven cuts in 2024 and early 2025. Meanwhile, the U.S. Federal Reserve maintained its key rate in a range of 4.25% to 4.50% despite persistent pressure to reduce the U.S. borrowing rate. The interest rate gap between the two countries is contributing to maintaining a relatively high cost of hedging against fluctuations in the U.S. dollar relative to the Canadian dollar.

Long-term bond rates have inched up since the beginning of the quarter, leading to a slight decline in bond returns. This increase in rates is due to a variety of factors, including inflationary pressures that were downplayed by the removal of the carbon tax from Canada’s most recent inflation estimates.

Lastly, the U.S. bill entitled One Big Beautiful Bill Act included the imposition of additional taxes on investors from any country designated as a “discriminatory foreign country,” presumably targeting Canada. However, in the version of the Act adopted on July 1, this measure was completely withdrawn, avoiding a potential impact on the vast majority of Canadian pension funds.

The market volatility in recent months serves as a reminder of the importance of having a robust governance framework for risk management. The Guideline No. 10 issued by the Canadian Association of Pension Supervisory Authorities (CAPSA) last September emphasizes that this framework must include a structured approach for identifying, evaluating, managing and monitoring significant risks. It not only focuses on investment risk but also on related risks associated with environmental, social and governance (ESG) issues and cybersecurity, which can have significant financial and non-financial impacts on benefits and plan members.

Regulators expect administrators to comply with this guideline. As a result, most administrators have begun the process of reviewing and adjusting their risk management practices to align with the best practices put forward, enabling them to better fulfill their fiduciary duty.

- Average funded ratio: 130% as at June 30, 2025, up 3% in the second quarter and up 1% year-to-date

- Average solvency ratio: 115% as at June 30, 2025, up 4% in the second quarter and up 1% year-to-date

- Second quarter returns higher than discount rates, but year-to-date returns comparable to discount rates

- Increase in discount rates over the quarter

We have developed a structured approach that can be tailored to different needs to help administrators comply with CAPSA Guideline No. 10. Contact your Normandin Beaudry consultant or email us.

The Normandin Beaudry Pension Plan Financial Position Index is calculated by projecting the pension plan financial data of its Canadian clients, excluding plans in the Quebec municipal and university sector. A separate index is published for these pension plans. Assets are projected based on the performance of market indices. Liabilities projected on a going concern basis use an estimated discount rate based on each plan’s asset allocation and the sensitivity of asset classes to changes in interest rates on Government of Canada bonds. The discount rates used on a solvency basis are those prescribed by the Canadian Institute of Actuaries, and those for transfer values are therefore based on the previous month’s market interest rates.