February 2022

Estimated solvency funded status of defined benefit pension plans in Ontario as at December 31, 2021

On February 8, 2022, the Financial Services Regulatory Authority of Ontario (“FSRA”) published its last 2021 Quarterly Update on Estimated Solvency Funded Status of Defined Benefit Pension Plans in Ontario, which outlines up-to-date information on the estimated solvency ratios of defined benefit pension plans in Ontario as at December 31, 2021.

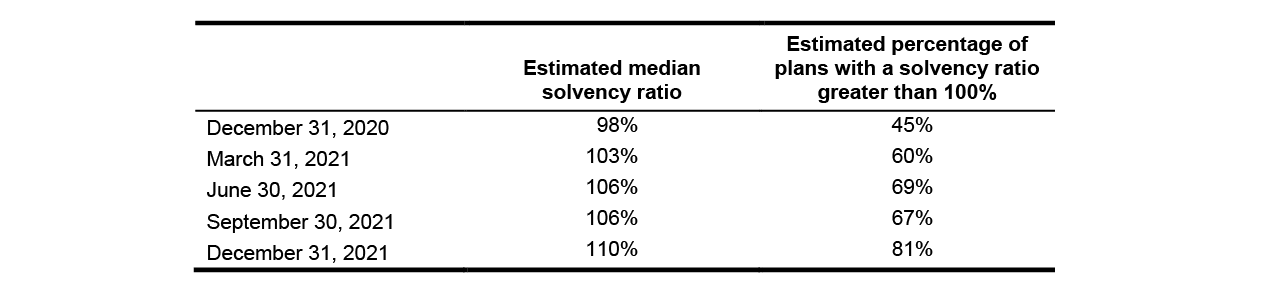

In this report, FSRA states that the estimated median solvency ratio sits at an impressive 110%, compared to 98% last year. The following table shows a comparison of the evolution of a few metrics over the last year:

As a result of the recent increase in solvency ratios and in the percentage of fully solvent plans, plan sponsors could consider this increase as an opportunity to reassess their funding and risk management strategies.

For example, the filing of an actuarial valuation—even if not required immediately—may result in an overall reduction in special payments required to eliminate deficits. Furthermore, it could also reduce or eliminate the contribution required to the Pension Benefit Guaranteed Fund.

Finally, as a de-risking strategy, it may be beneficial to consider the purchase of an insured annuity contract for plan members receiving pensions. With a fully solvent plan, it may be possible to do so at little or no relative cost to the plan.

Normandin Beaudry consultants will continue to monitor Ontario pension sector news and developments with FSRA’s activities and will keep you informed. Feel free to contact us if you have any questions, or if you wish to discuss in more detail how a particular plan may benefit from this situation.