March 2023

Announced Changes to the Québec Pension Plan

In tabling its budget on March 21 (Budget 2023-2024), the Quebec government took the opportunity to also announce its planned changes to the Québec Pension Plan (QPP). These changes come on the heels of the recent public consultation that took place in February. Our experts have analyzed the announced changes based on the available information.

The law requires the Quebec government to hold a public consultation on the QPP every six years to update the plan and adapt to the challenges being faced.

In its latest consultation document titled A Plan Adapted to the Challenges of the 21st Century, the government expressed its wish to consult the public on the minimum and maximum retirement pension eligibility ages and measures to foster job retention for people over age 65.

Special consultations and public hearings were held in February 2023 in the context of the Committee on Public Finance.

Upon completion of the Committee’s work, the Quebec government is proposing the following changes to the QPP starting January 1, 2024:

- Modify the pension calculation rules to prevent the job earnings of workers over 65 who deferred their pension from reducing the average earnings used to calculate their pension.

- Make QPP contributions as of age 65 optional for those receiving pension benefits.

- Raise the maximum retirement pension eligibility age to 72.

The announced changes are intended to adapt the QPP to the evolving retirement needs of Quebecers. The transition to retirement is more and more of a gradual process, meaning that some people earn employment income at a more advanced age. These changes therefore provide beneficiaries with more financial planning options.

We also welcome the government’s decision to keep the minimum pension age at 60. This decision maintains the flexibility needed to meet the diverse needs of the labour pool. In an effort to postpone pension payments further, the government will ask Retraite Québec to increase awareness on the implications of starting the payment of pension benefits before age 65 so that QPP contributors can make informed decisions that are right for them.

Budget 2023-2024 introduces a protection mechanism to prevent job earnings after age 65 from being considered in the average earnings used in the calculation if they reduce the QPP pension. This change supports the new reality of a gradual transition to retirement.

We believe this new measure would eliminate people’s fear of having their QPP pension affected by a lower income after age 65. Therefore, those who wish to work part time past age 65 or have the means to dip into their personal savings could defer the start of their QPP payments with the assurance that their benefits will increase as planned.

Budget 2023-2024 provides that QPP contributions as of age 65 would now be optional for those receiving pension benefits. This new option would be closer in line with the Canada Pension Plan (CPP). This means that workers receiving QPP benefits could now choose to stop contributing to the QPP after age 65. We believe this new option would offer greater flexibility by letting each person decide whether or not continuing their contributions makes sense for them.

In Budget 2023-2024, the government announced its intention to raise the maximum pension age from 70 to 72. We welcome this initiative, which will bring greater flexibility and a new decumulation environment to Quebec.

An important distinction must be made between postponing the retirement date and deferring the start of government pension payments because these two events do not necessarily coincide. What needs to be pointed out here is that the main purpose of the change is not to encourage people to put off their retirement, but rather give those who want to defer the start of QPP pension payments the option to do so. This measure makes it easier to manage longevity risk, or the risk of running out of savings before death.

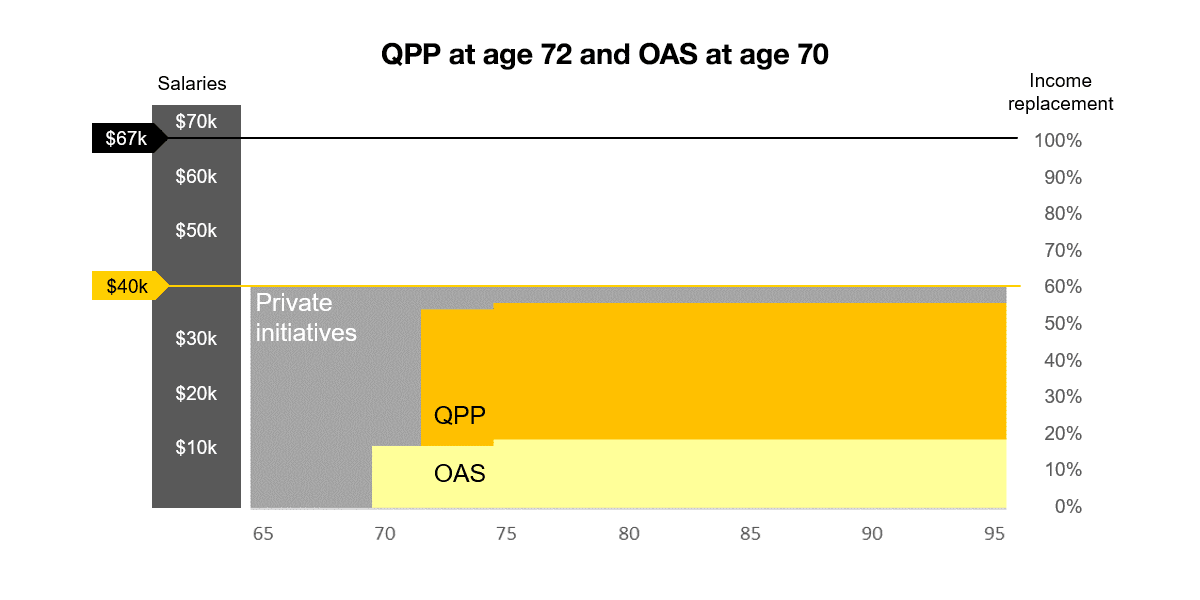

Based on our expertise, this is an excellent measure to bring retirees peace of mind. It would allow beneficiaries to optimize the use of personal savings, while mitigating the risks of outliving or using up their savings too quickly. The QPP pension, enhanced following deferral to age 72, would cover a greater proportion of income as of that age. This measure, combined with the other changes set out above, would simplify and limit decision-making regarding investments and decumulation to a certain number of years after retirement, since retirement income from the QPP would be predictable, indexed and guaranteed.

All in all, the proposed changes will offer greater flexibility. People can already decide to defer the start of their pension for higher benefits later on because they are working part-time, want to live off their personal savings or are receiving benefits under a private pension plan. Once the changes take effect, they will be able to do this without the risk of a lower income affecting their pension after age 65.

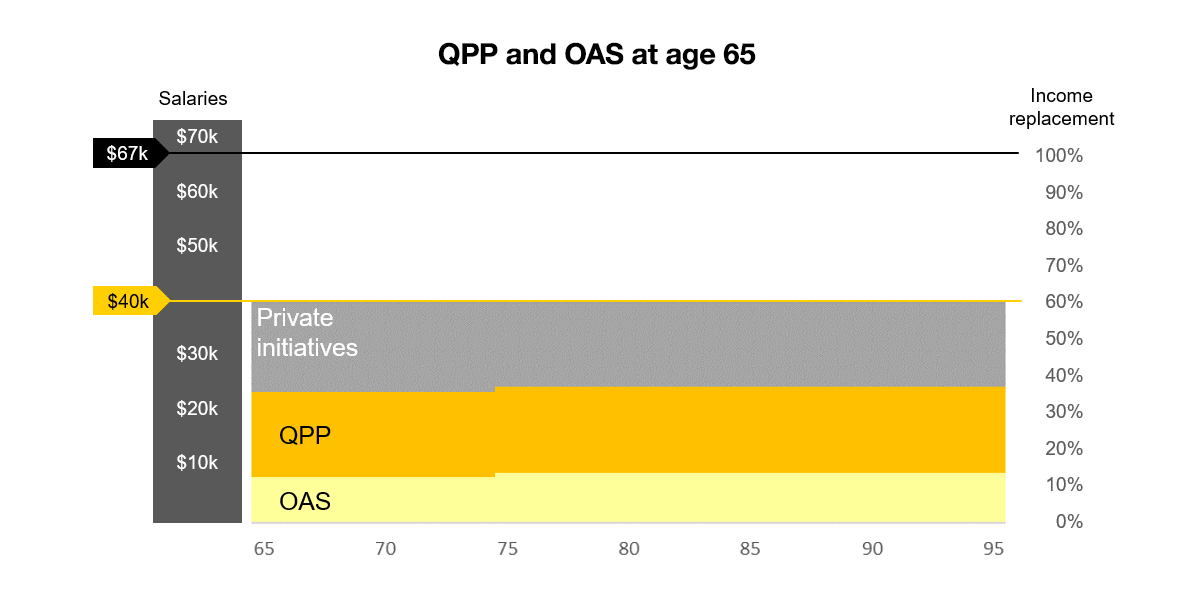

In our opinion, these changes will make deferring government pensions, QPP and Old Age Security (OAS) an attractive option for the Quebec population. Since these pensions are predictable sources of income that are guaranteed and indexed until death, it is often beneficial and less risky to defer them and first use up income from private initiatives. These private initiatives include personal savings, private pension plans and employment income. For illustration purposes, the following charts show a breakdown of retirement income with and without a deferral of government pensions.

We welcome the government’s decision to raise the maximum pension age to 72 and believe this maximum could be raised further to age 75 during the next public consultation.

On February 1, the government also tabled Bill 7 – An Act respecting the implementation of certain provisions of the Budget Speech of 22 March 2022 and amending other legislative provisions. This Bill proposes amendments to decumulation rules and suggests greater decumulation flexibility as of age 55. Although the extent of the proposed amendments is not yet known, this Bill, combined with the announced changes to the QPP and the enhancements to the QPP in effect since January 1, 2019, offers a range of options for better financial security.

In closing, it is important to note legislative and regulatory changes will be needed before the QPP changes announced in the Budget on March 21, 2023, can take effect. Our experts will be watching developments closely to keep you informed.

Would you like more information? Contact your Normandin Beaudry consultant or email us.