November 2018

Major reshuffling of the GICS sectors

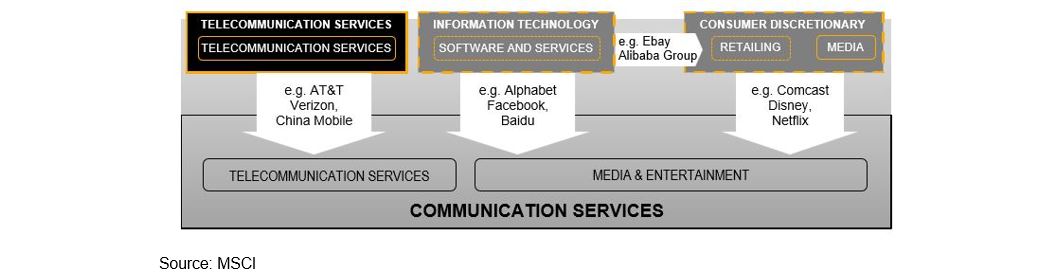

In this era of evolution and revolution of communication methods, technologies and access to information, organizations have no choice but to adapt. A growing number of companies are moving in that direction by modifying their business model to become fully integrated and provide their clients with comprehensive solutions. For instance, companies like Google, which started off as a web search engine company, has grown to become the communication and multimedia titan it is today with the Android platform, Google Drive, YouTube and countless others. Given this new reality, in late 2017 Morgan Stanley Capital International (MSCI) and Standard & Poor’s Dow Jones (S&P), two leading index providers, decided to review the Global Industry Classification Standard (GICS) structure, the most commonly used structure across the world.

Following consultations, sweeping changes were made to GICS sectors in 2018 to reflect the new reality of tech and communication companies. The changes were implemented after the market close on September 28. This marks the biggest sector structure changes in GICS history, considering the sheer market capitalization volume of the companies affected. This reorganization affects all S&P and MSCI indices and affects more than 1,000 global stocks that have moved sectors.

- The Telecommunication Services sector was renamed Communication Services.

- Media companies were transferred from the Consumer Discretionary sector to the new Communication Services sector.

- Internet service companies from the Information Technology sector were also transferred to the Communication Services sector.

- E-commerce companies were transferred from the Information Technology sector to the Consumer Discretionary sector.

- Several sub-sectors/industries within the three sectors mentioned above were created to accommodate the new companies that will eventually be added to each new sector.

- Following these movements, the number of GICS sectors remains unchanged at 11.

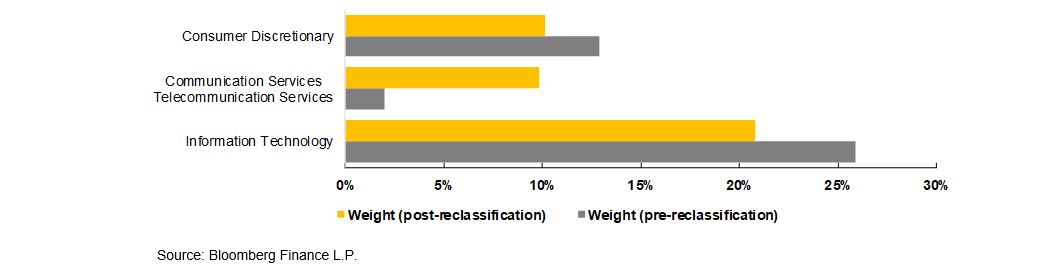

The graph below shows the weight of the sectors affected by these changes on the S&P 500.

The Information Technology sector shrunk by approximately 5% while the Consumer Discretionary sector contracted by about 3%. The Communication Services sector’s weight now hovers around 10%. The impact of these changes is similar for global indexes, such as the MSCI World Index.

In fact, the Communication Services sector now consists of approximately 30% of companies from the Consumer Discretionary sector, 50% from the Information Technology sector and 20% of the former Telecommunication Services sector.

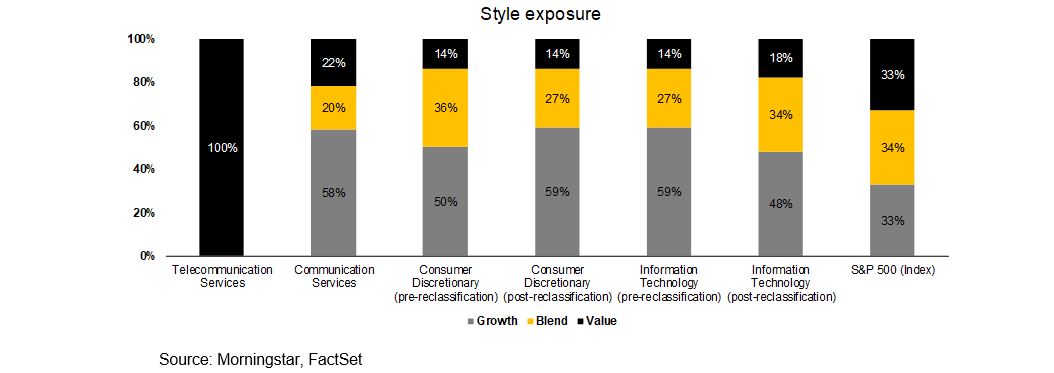

The Telecommunication Services sector had always been viewed as a defensive sector with its high-dividend stocks. However, the new sector’s composition is markedly different. The graph below illustrates the breakdown of sector style exposure, pre- and post-reclassification, to the “value”, “growth” and “blend” factors.

The legacy Telecommunication Services sector, which was regarded as a 100% value sector, now holds primarily “growth” companies as the Communication Services sector. This new sector will therefore most likely be underweighted by defensive strategies, while its predecessor was often overweighted by these types of strategies.

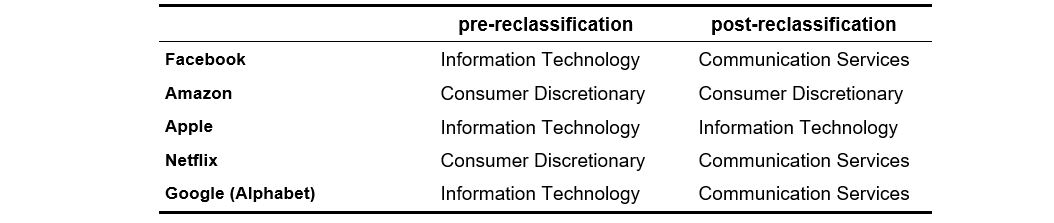

For information purposes, here’s what happened to FAANG stocks following the GICS reshuffle:

Changes to the different indexes may influence the strategies of portfolio managers as well as the methodology used to assess their performance. Pension and investment committees should therefore double down on vigilance and question managers on issues that may arise from these changes.

Would you like more information?

Contact your Normandin Beaudry consultant or email us.