August 2016

Enhancing your bond portfolio with the liquidity premium

In recent years, Canadian investors have seen interest rates fall dramatically. The rate for 10-year federal bonds fell from 6% at the beginning of the 2000s to under 1% in the 3rd quarter of 2016. This decrease allowed investors to generate good returns. However, the future prospects for traditional bonds are now poor.

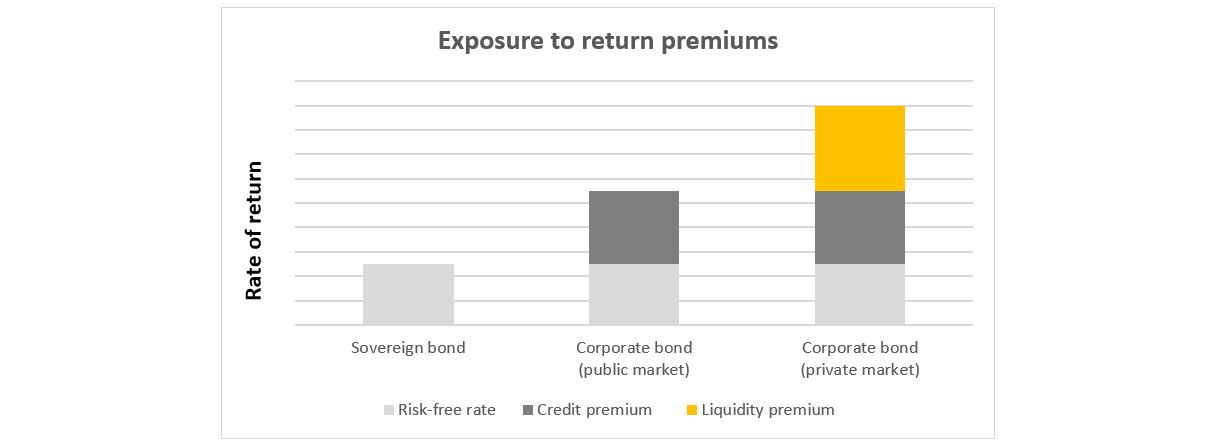

One of the common approaches adopted by investors to enhance the return of their bond portfolio is to increase the exposure to the credit premium. The credit premium is the additional return obtained to make a loan to an issuer that is riskier than a government. Although this premium continues to be attractive, it is possible to further improve the return through exposure to another well rewarded risk: liquidity risk.

An investment in a security that cannot be sold before and must be held until maturity provides an additional return to compensate for this lack of liquidity. Private debt is the fixed income category that provides access to this liquidity premium. This type of investment does not necessarily pose a greater financial or credit risk, but the limited or non-existent access to the invested capital allows the investor to obtain a significantly higher return. In contrast, an investor that purchases bond securities traded on public markets that provide some liquidity will obtain lower rates of return in exchange for transactional liquidity.

Interest in this liquidity premium has increased gradually in recent years for various reasons.

First, this premium now accounts for a very substantial proportion of a bond portfolio’s total return, given the very low risk-free rates.

Second, growing knowledge of alternative investments such as real estate, infrastructures and private investments, allows investors today to consider private debt as an extension of the investment categories to be included.

And, finally, in the wake of the financial crisis of 2008, changes to the regulation of the global banking system resulted in an increase in this liquidity premium. Since the Basel III agreement was reached, there have been fewer traditional credit sources. In other words, banks no longer have the flexibility nor the financial capacity required to make loans to certain types of borrowers requesting less standard borrowing conditions. Private funds or managers offering greater flexibility and swift execution can therefore lend at higher interest rates. For an investor with few liquidity constraints and a long-term horizon, it is becoming worthwhile and important to consider exposure to this return premium.

The private debt market allows for exposure to the liquidity premium. This market includes private loans to businesses, loans for infrastructure projects and mortgage loans backed by commercial properties.

Private corporate debt funds that are especially attractive to investors are typically composed of loans to small or medium-sized businesses. These loans are tailored to the reality and needs of borrowers and are negotiated directly between the investor and the borrower. These loans are backed by businesses’ assets and cash, and strong protection clauses. Because publicly traded corporate debt is not backed by assets, loss rates in the event of default are often higher for public debt than for private debt for businesses of equivalent quality.

Infrastructure debt and commercial mortgage debt are loans made to finance tangible assets, such as infrastructure projects or commercial buildings. These assets are typically used as collateral, which reduces the risk for investors in the event of default by the borrower. Unlike direct investments in these infrastructure projects or commercial buildings, the loans are made on a fraction of the assets, with a first or second rank seniority on all of the assets. They therefore benefit from a cushion in the event of a decline in the value of the underlying assets that is absorbed by equity investors. This is an enviable position in the capital structure in more difficult economic conditions that helps to stabilize returns.

For these three types of investments, there are many risk-return profiles based on the borrower’s credit quality, the positioning in the capital structure and the protection clauses negotiated. The higher the level of risk, the higher the credit and liquidity premiums.

It is necessary to have a clear understanding of the risk-return profile of the different products available on the market before making an investment. The private debt expertise required is complex and advanced and it is difficult to compare funds to one another. This is why education efforts and governance mechanisms associated with investing in these private markets are so important.

Please feel free to contact us for additional information.