June 2016

Accounting standards applicable to employee future benefits: What assumptions do Canadian companies use?

Several private sector organizations must include the recognition of their obligations toward defined benefit pension plans (DB plans) and group insurance plans offered to retirees (other post-retirement benefits) in their financial statements.

The assumptions required to determine the defined benefit obligation and the defined benefit cost (the expense) must be established by the organization’s management. Again this year, we have analyzed the annual reports of Canadian organizations listed on the S&P 60 Index (60 largest organizations) and on the S&P MidCap Index (mid-cap organizations) whose fiscal year ended between September 30 of the previous year and February 29 of the current year. Close to 75 organizations sponsoring at least one DB plan are included in our analysis and 70% of them are offering other post-retirement benefits. Finally, 85% of the organizations disclose their results in accordance with IAS 19, and the remaining 15% percent disclose them in accordance with U.S. accounting standards.

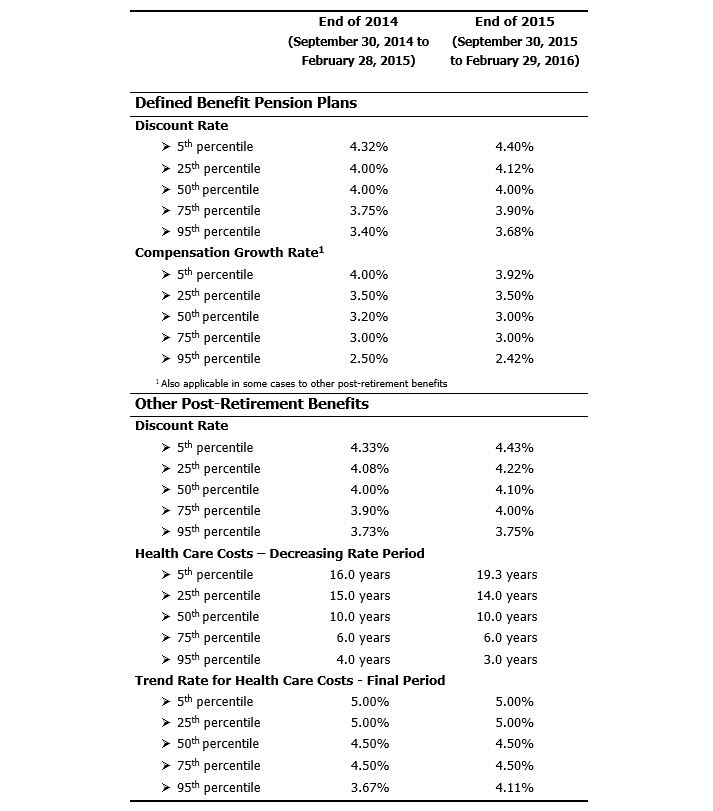

Our analysis is divided into three sections. The first section presents the assumptions used by the organizations included in our analysis in percentile format. The tables present a comparison of the assumptions used for fiscal years ending in 2015 (between September 30, 2015 and February 29, 2016) and in 2014 (between September 30, 2014 and February 28, 2015). The second section summarizes the findings from these tables and from our data analysis. The third and final section presents additional information with respect to measures that could potentially impact future accounting results for some organizations.

The tables present, in percentile format, the key economic assumptions used by the organizations analyzed for DB plans and other post-retirement benefits. The assumptions are those that were in effect at the end of the fiscal year considered and used to calculate the obligation at this date.

- For DB plans, the discount rate assumption is the most important assumption. Because it is based on market rates, it can vary from month to month. According to our analysis, the median annual discount rate of 4.00% used at the end of 2015 is the same as the rate used at the end of 2014. Interest rates continued to be low at the end of 2015.

- Several of the organizations analyzed sponsor DB plans and other post-retirement benefits that offer benefits based on salary at retirement. These organizations must therefore establish an assumption related to the compensation growth rate. A downward trend in the median annual growth rate began in 2012. The median annual growth rate was 3.20% at the end of 2014 and this rate fell to 3.00% at the end of 2015. Outlooks for the compensation growth rate for accounting recognition purposes have therefore decreased over the past few years.

- For organizations sponsoring both DB plans and other post-retirement benefits, the median discount rates used for all plans were similar. Hence, 50% of the organizations analyzed were using a discount rate for other post-retirement benefits identical to that used for DB plans at the end of 2015.

- The trend rate for health care costs is an important assumption for other post-retirement benefits. The initial rate, which is higher than the final rate, can vary significantly from organization to organization. The final rate varies less from organization to organization and the median final trend rate has been relatively stable at 4.50% for the past several years.

- Some organizations are starting to use the new approach concerning the discount rate assumption that we mentioned last year and that was being discussed on the market. This approach involves the use of several discount rates to reflect the different benefits payment schedules for active employees and retirees participating in the same plan. Several issues have been raised in relation to this approach; however, market stakeholders (organizations, auditors, actuaries) gradually clarified their level of comfort with the approach. The Security Exchange Commission’s confirmed acceptance of the approach and of its implementation as a change in accounting estimate under certain conditions, is one of the factors that helped move the reflection process forward.

- The International Accounting Standards Board continues to analyze the responses to the exposure draft aimed at clarifying that, in cases where the defined benefit obligation is remeasured during the year (amendment, curtailment or settlement), the current service cost and net interest for the remaining period should be calculated using the same assumptions as those used for the remeasurement. The next steps should be determined by early fall at the latest. It should be noted that the Canadian Accounting Standards Board issued a response to the exposure draft that included its views on the retrospective application of the clarification.

Please feel free to contact us for additional information.