March 2021

Impact of COVID-19 on mortality rates and ramifications for group benefits plans

We’ve all witnessed the devastating effects of COVID-19 on our everyday life and on our loved ones. The virus has unfortunately taken the lives of too many people. What impact will this have on the mortality of Canadians and how will this uptick in deaths affect group benefits plans offered to workers and retirees?

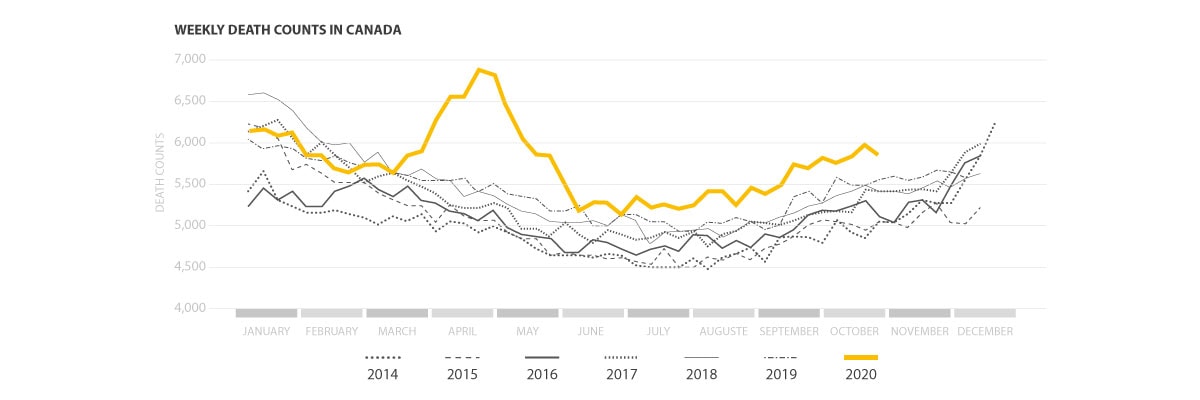

The following graph presents the weekly number of deaths in Canada in recent years, compiled by Statistics Canada.

Backed by data from StatsCan and the Institut de la statistique du Québec, it’s believed that COVID-19 generated 5% additional deaths in Canada last year. As expected, COVID-19 had a greater impact on mortality in Quebec, with nearly 8% additional deaths.

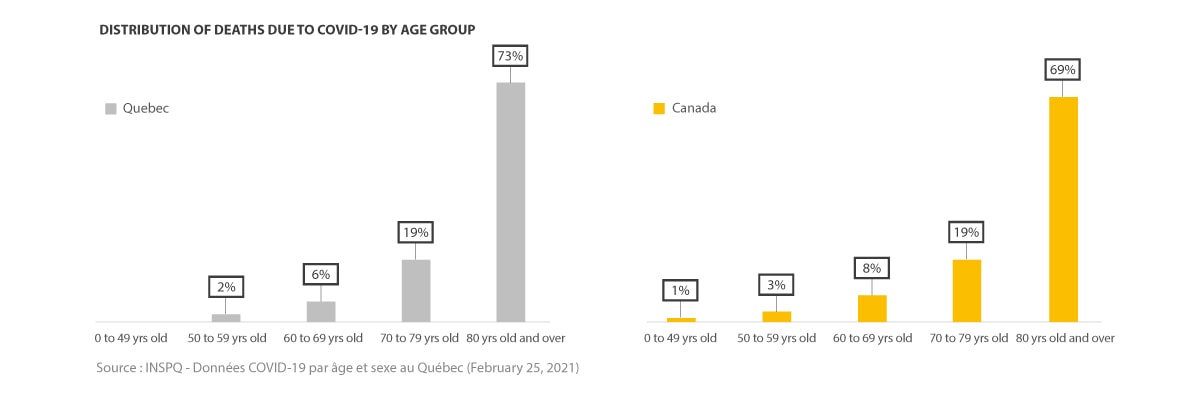

According to data published by the Government of Canada, individuals ages 70 and over account for 88% of COVID-19 deaths, with 69% of those deaths occurring in individuals ages 80 and older. The percentage of COVID-19 deaths among these age groups is even higher in Quebec (92% of deaths among those ages 70 and older, with 73% occurring among those 80 and older), according to the Institut national de la santé publique du Québec (INSPQ).

As these age groups comprise mostly retirees, we will analyze the cost of group benefits (pension plans and group insurance plans) offered to those individuals.

At first glance, we can expect more deaths occurring in 2020 than previously expected. For example, a group benefits plan covering 1,000 retirees with a median age of 70 could expect anywhere from 10 to 20 deaths in a given year. In 2020, the impact of COVID-19 resulted in an average of one or two additional deaths.

As mentioned, individuals ages 80 and older have been most affected by COVID-19. In general, the pension plan liabilities for this subgroup of retirees are small compared to other subgroups. Therefore, the experience variation as a result of increased mortality due to COVID-19 for 2020 should be rather limited, with some exceptions. We can expect little to no variation in pension plan funding costs as a result of the impact of COVID-19 on mortality in 2020.

COVID-19 may take a toll on premiums payable to the insurer. For plans offering life insurance coverage at retirement, the impact of the coronavirus will depend on group size and the renewal methodology.

Companies offering life, health and dental insurance coverage to retirees must acknowledge the costs of these plans in their financial statements. Just like pension plans, the liabilities for retirees over the age of 80 are small compared to other insured people. We can therefore expect little to no variation in costs as a result of the impact of COVID-19 on mortality in 2020.

It is too early to assess the long-term impact of COVID-19 on mortality rates, given the many factors that could influence future developments, such as:

- Additional waves of the pandemic

- Survivorship bias, or the belief that those who survived the pandemic may have physical attributes related to greater longevity

- Long-term effects on the health of COVID-19 survivors

- The impact of the cancellation or postponement of healthcare treatment and surgeries. Over time, the current situation may have a serious impact on the recovery of those awaiting treatment and, in the long term, on the life expectancy of Canadians.

- Mental health impact of social isolation and job losses

- Behavioural changes, such as frequent handwashing, may have beneficial long-term effects. This good habit could curb the transmission of other yearly viruses, such as influenza, which would reduce the yearly number of deaths.

With this in mind, it would be best to maintain the mortality assumptions currently used for estimating future costs of pension plans and group insurance plans. As a result, costs are expected to remain stable in the short term.

Your Normandin Beaudry consultants are monitoring the situation as it evolves and will keep you informed.

Would you like more information?

Contact your Normandin Beaudry consultant or email us.