July 2019

Changes to the stabilization provision: What does this mean for your plan?

On July 3, the Quebec government published a draft Regulation amending the Supplemental Pension Plans Regulation. The draft Regulation’s main objective is to revise some parameters used to determine the stabilization provision for actuarial valuations starting December 31, 2019.

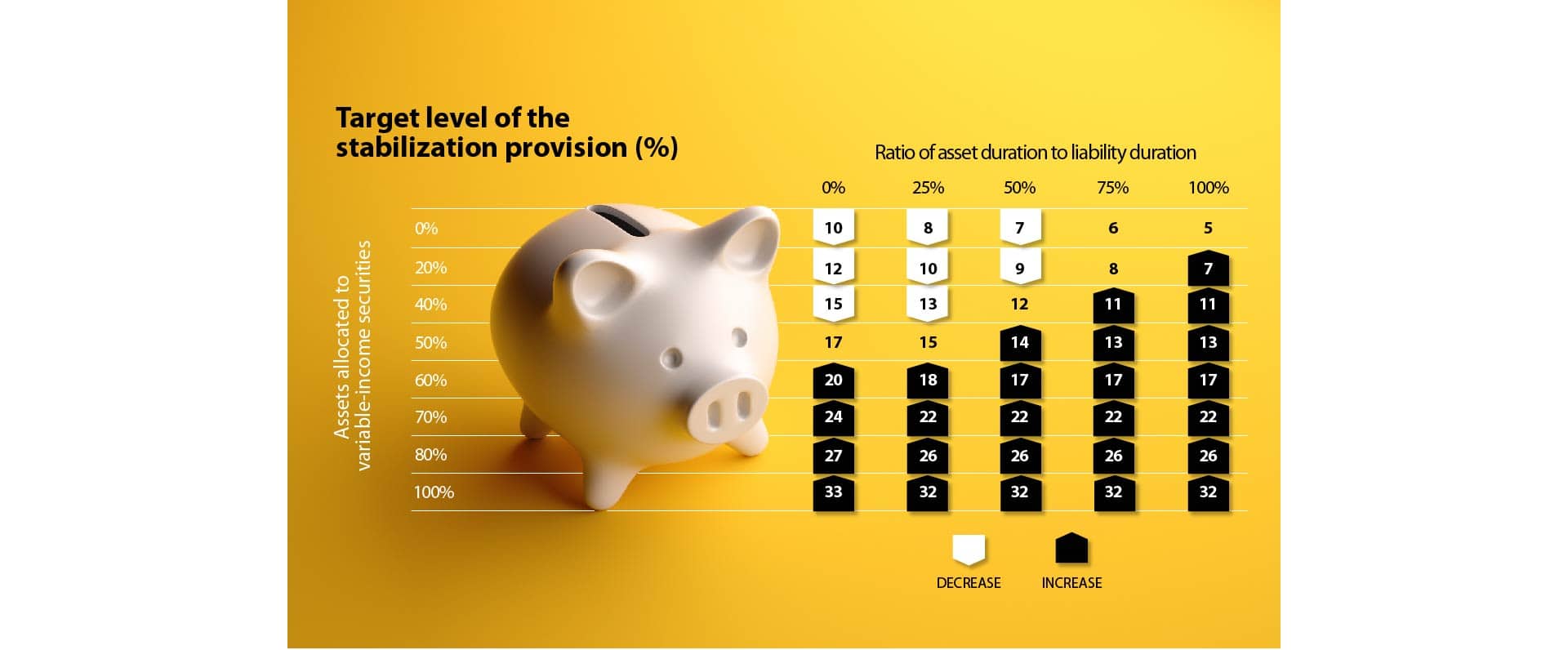

First, the chart used to determine the stabilization provision will be revised as follows:

With the revised chart, there will be an increase in the stabilization provision for plans with a significant proportion of assets allocated to variable-income securities. There would be a particularly marked increase for plans that use bond overlay strategies, which tend to be found on the right-hand side of the chart. On the other hand, these changes would result in a lower stabilization provision for plans with little exposure to variable-income securities.

Furthermore, under the draft Regulation, private debt investments, that are not rated by credit rating agencies, would now be considered as fixed-income securities, up to 10% of total plan assets. Should this draft Regulation be adopted, private debt managers would have to certify once a year that the credit quality of their investment products is at least equivalent to the credit quality of publicly traded fixed-income securities that are recognized by the regulation. The pension committee would also have to attest that it has obtained the required certifications when preparing actuarial valuations.

If adopted, these new measures would lead to funding contribution increases for many private sector defined benefits pension plans in Quebec.

The draft Regulation also provides increasing the upper limit of fees to be paid to Retraite Québec when filing the annual information return. Starting December 31, 2019, the maximum annual fee would increase from $100,000 to $150,000 and would be indexed every year thereafter. This measure would only affect larger pension plans of approximately 10,000 members or more.

Lastly, the draft Regulation proposes to reduce the information required in partial actuarial valuation reports. Our consultants will analyze the scope of these changes.

Contact us if you have any questions about this draft Regulation.