June 2019

Accounting standards applicable to future group benefits: assumptions used by Canadian organizations

Several private sector organizations must include the recognition of their obligations toward defined benefit pension plans (DB plans) and group insurance plans offered to retirees (other post-retirement benefits) in their financial statements.

Again this year, we analyzed the annual reports of Canadian organizations listed on the S&P 60 Index (60 largest organizations) and on the S&P MidCap Index (mid-cap organizations) whose fiscal year ended between September 30 of the previous year and February 28 of the current year.

- More than 65 organizations sponsoring at least one DB plan are included in our analysis and 72% of them offer at least one medical care plan to their retirees.

- Moreover, 85% of the organizations disclose their results in accordance with international accounting standards, while the remaining 15% disclose them in accordance with U.S. accounting standards.

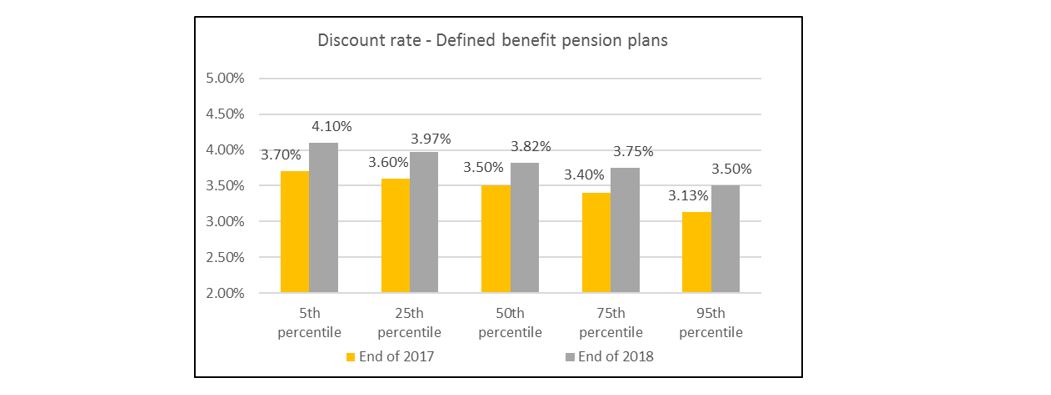

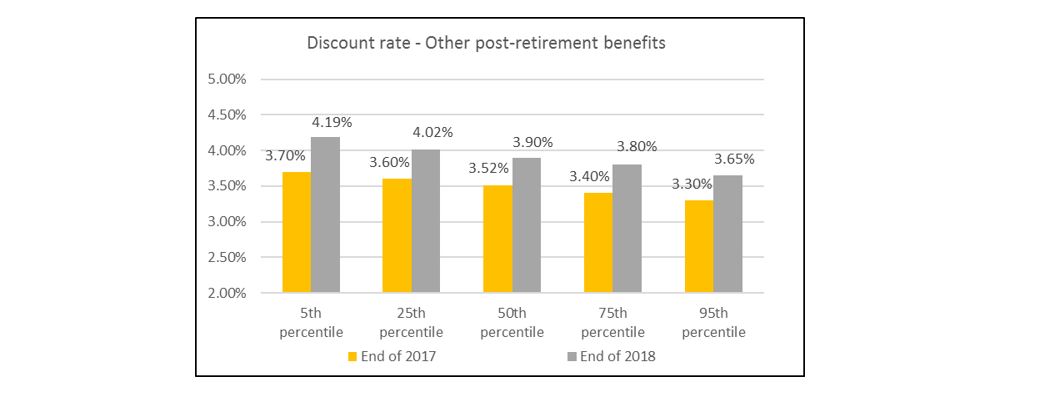

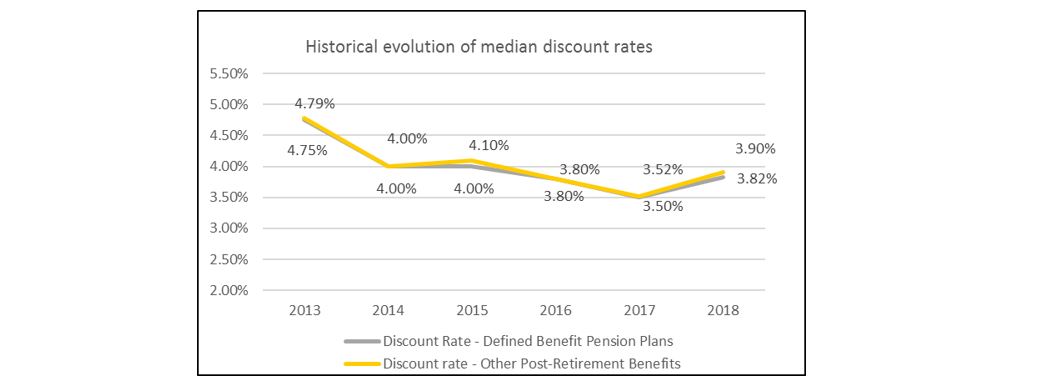

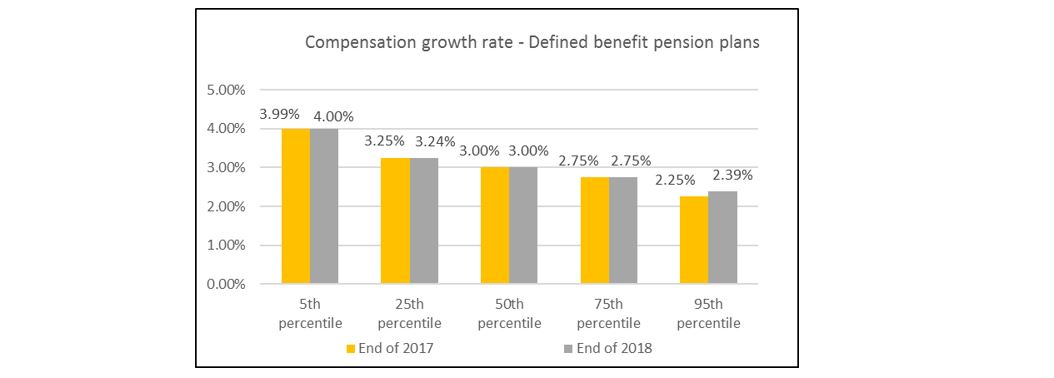

The following charts present the key economic assumptions used by the organizations analyzed for DB plans and other post-retirement benefits. The assumptions are those that were in effect at the end of the fiscal year considered and used to calculate the obligation at the end of the fiscal year.

For DB plans, the discount rate assumption is the most important assumption. Because it is based on market rates, it can vary from month to month.

- The median annual discount rate used at the end of 2018 was 0.32% higher than the rate used at the end of 2017 (3.82% versus 3.50%).

- Increases in short- and long-term interest rates of corporate bonds were observed over the course of 2018, which resulted in an increase in discount rates for all organizations analyzed.

- For organizations sponsoring both DB plans and other post-retirement benefits, the median discount rates used for all plans were similar.

- Having said that, at the end of 2018, 54% of the organizations analyzed were using a discount rate for other post-retirement benefits identical to that used for DB plans.

- The historical evolution of median discount rates also shows the trend of using identical rates between the two types of benefits.

- Additionally, an upward trend in the rate level has been observed for the first time since the rate hike of late 2013.

Many of the organizations analyzed sponsor DB plans and other post-retirement benefits that offer benefits based on salary at retirement. These organizations must therefore establish an assumption related to the compensation growth rate of active members.

- The median annual compensation growth rate is holding steady at 3.00%, the rate observed at the end of 2017. Outlooks for the compensation growth rate for accounting recognition purposes have been stable since 2015.

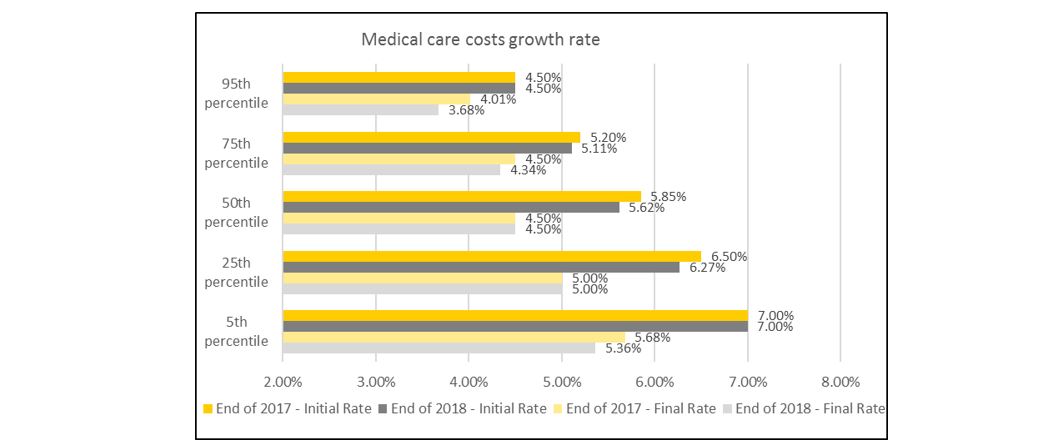

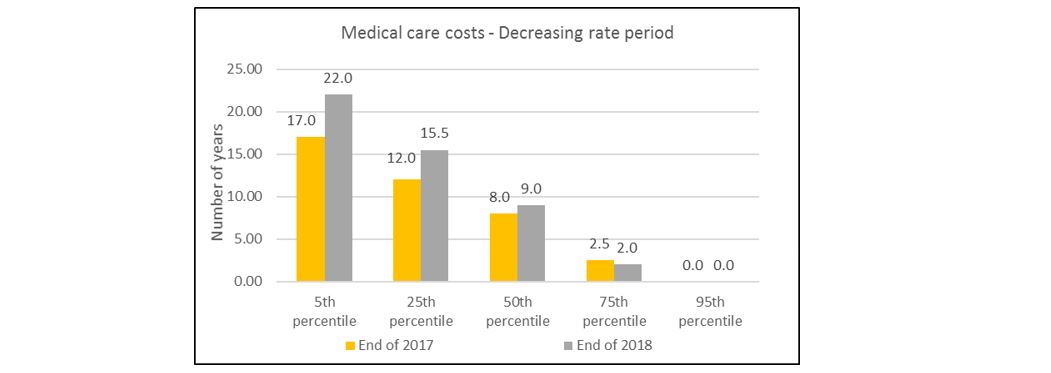

The trend rate for medical care costs is an important assumption for other post-retirement benefits, as it influences the future level of costs and its growth is higher than overall inflation.

- The initial rate, which is higher than the final rate, can vary significantly from organization to organization.

- The final rate varies less from organization to organization and the median trend has been relatively stable at 4.50% for several years.

- The timeframe to reach the final rate can also vary significantly from organization to organization. The median at the end of 2018 was one year higher than the median used at the end of 2017 (nine years versus eight years).

In October 2018, the Public Sector Accounting Board (PSAB) published an Invitation to Comment on the provisions to recognize non-traditional pension plans, included in Sections PS 3250 and PS 3255. In non-traditional plans, the employer shares different degrees of risk with their employees and/or other employers. The Invitation to Comment was to allow the PSAB to:

- obtain comments from various market participants on provisions to recognize non-traditional pension plans, and

- identify potential alternatives and related considerations to examine before taking a position and publishing a new proposed Section on employment benefits through an exposure draft.

In 2016, the PSAB began its project to review Sections PS 3250 and PS 3255 and to eventually publish a new Section on employment benefits. The Invitation to Comment on non-traditional pension plans addresses phase II of the project. Phase I addressed the deferral provisions (for which an Invitation to Comment was published in November 2016) and discount rate provisions (for which an Invitation to Comment was published in November 2017).

In 2018, an issue was raised with the Accounting Standards Board (AcSB) for enterprises electing to use a funding valuation in accordance with Section 3462, Employee Future Benefits. This issue is regarding the diversity arising in practice as to whether the provision for adverse deviations or the stabilization provision is included in the measurement of the defined benefit obligation.

This issue is a result of changes to pension plan legislation in Quebec and Ontario to include a provision for adverse deviations for the funding purposes of the plan. The AcSB continued its discussion on this matter during a meeting on March 6 and 7, 2019, and decided to undertake standard-setting action. It decided to develop an exposure draft to clarify that the stabilization provision should be included in the measurement of the defined benefit obligation when the enterprise elects to use the funding valuation. Therefore, the requirement to include the provision should also apply to the measurement of the defined benefit obligation for unfunded plans. The AcSB will also consider including transitional provisions in the exposure draft.

The AcSB continued its discussions and consultations in May 2018 and was planning to approve, during its meeting on June 18, the content of the exposure draft, which should be issued no later than the third quarter of 2019.

Our specialists assist many clients in preparing their financial statements. We can help you comply with current standards. Contact us!